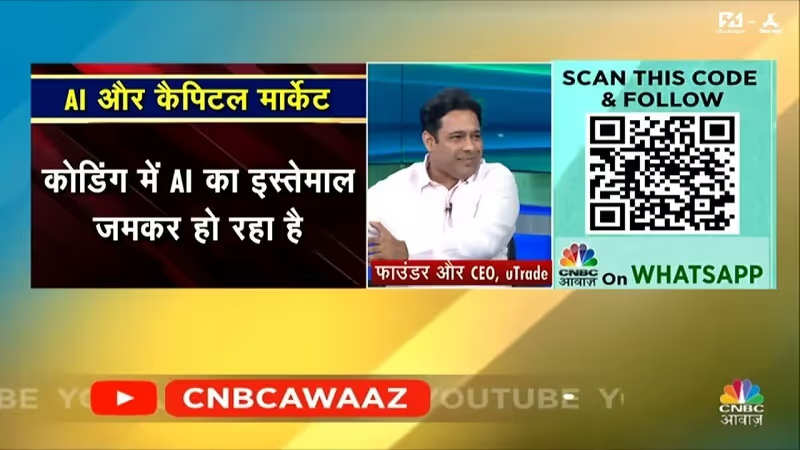

Delivering Algo Trading Technology for more than

14 years in India

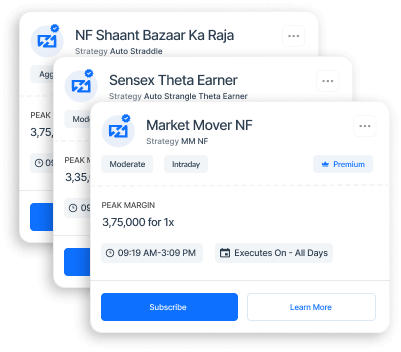

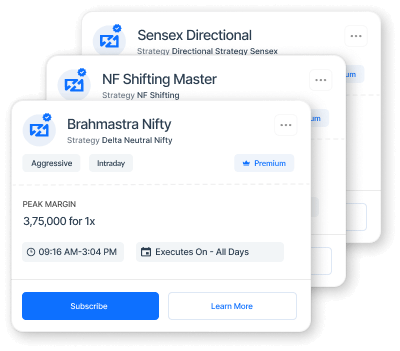

Learn the full process from strategy creation to deployment, equipping you with essential trading skills.

Approved Algo Vendor for NSE and BSE

Ensuring exchange-approved standards and seamless integration.

VAPT and ISO Certified Infrastructure

With continuous audits to ensure security, stability, and resilience.