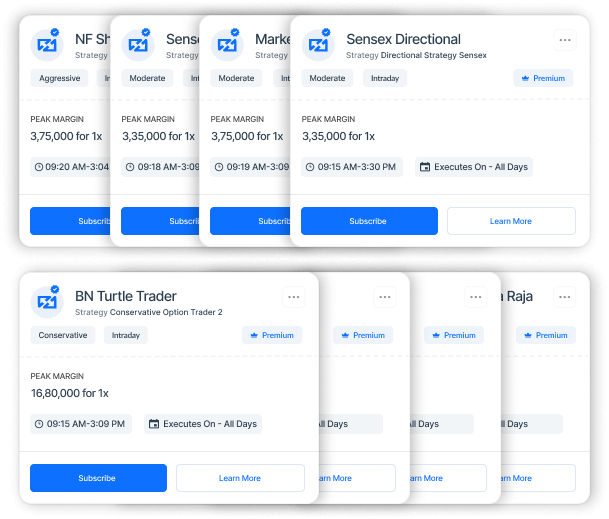

uTrade Originals

Gone are the days of spending countless hours analysing market trends. With uTrade Originals, just choose an algo trading strategy that aligns with your objectives and subscribe to it. Our powerful expert-made algo trading strategy will then take the reins, executing trades on your behalf.