1. Time-Saving

Developing a custom algorithm from scratch can be a time-consuming process that requires extensive research, testing, and optimisation. Pre-built algorithms, on the other hand, are ready-to-use solutions that can be deployed almost immediately. This time-saving aspect allows traders to focus on other critical aspects of trading, such as market analysis and risk management, rather than getting bogged down in algorithm development.

2. Cost-Effective

Building a custom algorithm requires expertise in programming, quantitative analysis, and financial markets, which can be costly in terms of both time and money. Pre-built algorithms offer a cost-effective alternative, as they are typically available at a fraction of the cost of developing a custom solution. This cost savings can significantly lower the barrier to entry for algorithmic trading in India and elsewhere, making it accessible to a wider range of traders.

3. Reduced Emotional Bias

One of the key advantages of algorithmic trading programs, on platforms like uTrade Algos is the ability to execute trades based on predefined criteria without the influence of emotions. Pre-built algorithms are designed with specific trading rules and parameters, which helps to minimise emotional bias in decision-making. By removing the emotional element from trading, pre-built algorithms can lead to more disciplined and consistent trading outcomes.

4. Scalability

As traders' portfolios grow and trading volumes increase, scalability becomes a critical factor. Pre-built algorithms are often designed to handle large volumes of trades efficiently, making them highly scalable solutions. Whether you are trading with a small account or managing a large investment portfolio, pre-built algorithms can adapt to varying trade sizes and frequencies without compromising performance.

5. Continuous Updates and Support

The financial markets are constantly evolving, with new market conditions, regulations, and trading opportunities emerging regularly. Pre-built algorithms, on algo trading platforms like uTrade Algos, often offer continuous updates and support to adapt their algorithms to changing market conditions. This ongoing support ensures that traders have access to the latest strategies and optimisations, helping them to stay competitive in the dynamic world of algorithmic trading.

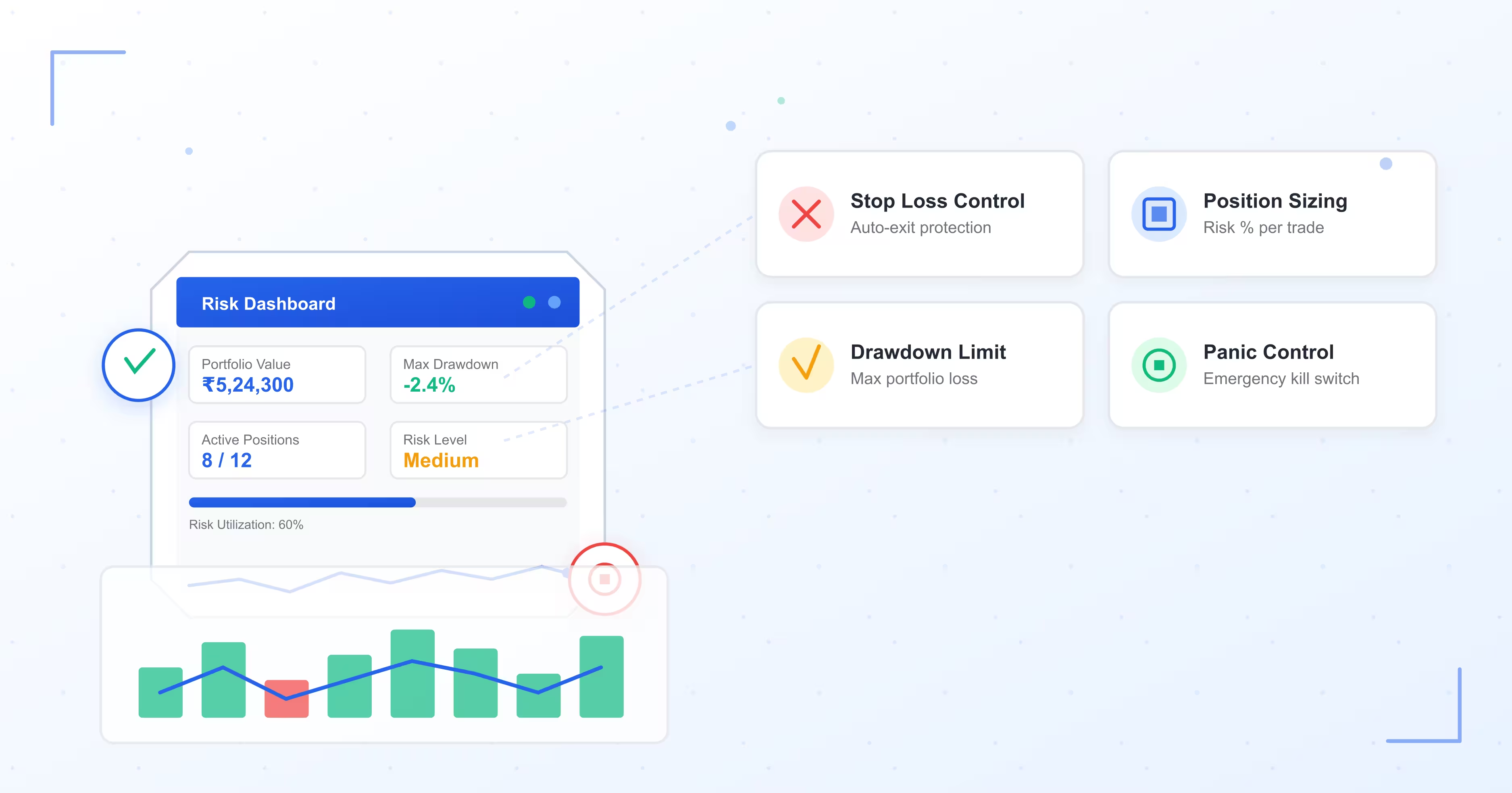

6. Diversification and Risk Management

Using pre-built algorithms allows traders to diversify their trading strategies across different asset classes, markets, and timeframes. This diversification can help to spread risk and reduce reliance on a single trading strategy or market condition. Additionally, many pre-built algorithms incorporate risk management features, such as stop-loss orders and position sizing rules, to help traders manage risk effectively.

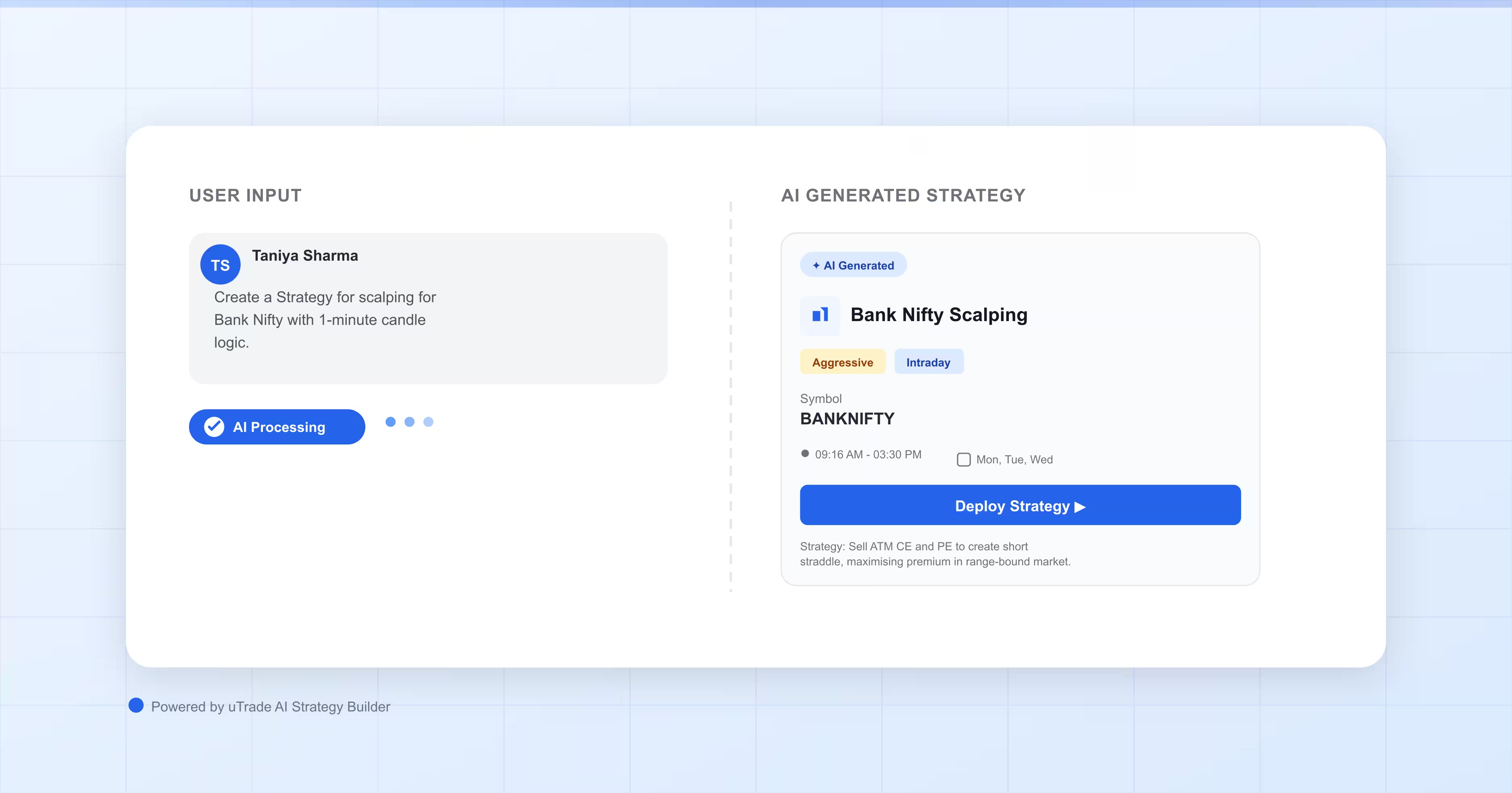

7. Accessibility and Ease of Use

Pre-built algorithms are designed to be user-friendly and accessible, even for traders with limited programming or technical skills. Many algorithm providers offer intuitive interfaces and detailed documentation, making it easy for traders to understand and implement the algorithms. This accessibility and ease of use democratise algorithmic trading, allowing more traders to take advantage of automated trading strategies without a steep learning curve.

What to Be Careful of When Using Pre-Built Algorithms for Algorithmic Trading

While pre-built algorithms offer numerous advantages for algorithmic trading software, it's essential to approach them with caution and be aware of potential pitfalls.

- Lack of Transparency: Some pre-built algorithms may lack transparency in their trading strategies and logic, making it difficult for traders to understand how trades are executed.

- Hidden Costs: While pre-built algorithms may seem cost-effective upfront, there may be hidden costs associated with licensing, data feeds, and platform fees.

- Limited Customisation: Pre-built algorithms may not always offer the level of customisation needed to adapt to specific trading styles, risk tolerances, and market conditions.

- Dependency on Providers: Traders may become overly reliant on pre-built algorithm providers for updates, support, and optimisations, which can pose risks if the provider discontinues the algorithm or fails to deliver timely updates.

- Compliance and Regulation: Traders must ensure that pre-built algorithms comply with relevant regulations and trading rules, as using non-compliant algorithms can lead to legal issues and penalties.

In conclusion, while custom algorithms offer flexibility and the potential for unique trading strategies, pre-built algorithms provide a range of benefits that can significantly enhance the efficiency and risk management of algorithmic trading in India and other parts of the world too. From time-saving and cost-effectiveness to reduced emotional bias and continuous support, pre-built algorithms offer a compelling solution for traders looking to capitalise on opportunities in the financial markets. Whether you are a novice trader or an experienced investor, considering the use of pre-built algorithms can be a strategic decision that aligns with your trading goals and objectives.