Historical Development of Algorithmic Trading in India

Algorithmic trading programs automate trade execution based on predefined strategies, leveraging mathematical algorithms for decision-making, thus eliminating human emotions from the trading process.

- SEBI introduced algorithmic trading in 2008 through Direct Market Access (DMA).

- DMA allows brokers to offer their infrastructure to clients for accessing the

- exchange system without intervention.

- Initially exclusive to institutional clients, DMA reduced costs and improved execution efficiency.

- By 29 April 2008, global players like UBS, Morgan Stanley, and JP Morgan showed interest in DMA.

- By 31 July 2008, brokerages like Citi, Merrill Lynch, and others were testing DMA software for synchronisation with exchange systems.

- Foreign Institutional Investors (FIIs) were permitted to use DMA facilities through nominated investment managers from 24 February 2009.

Role of Smart Order Routing, High-Frequency Trading, and Co-location

Smart Order Routing

- Automated process in algorithmic trading for order execution.

- Orders may go directly to the exchange or via a broker.

- Follows predefined rules to execute orders for optimal trade execution.

High-Frequency Trading (HFT)

- A subset of algorithmic trading focusing on small timescales.

- Utilises various strategies for rapid trading, including market making and data analysis.

- Involves exploiting price discrepancies and monitoring inventory risk for effective trading.

Co-location

- Data centre facility within the exchange premises.

- Offers space for trading firms to host servers and hardware.

- Provides essential resources such as power, bandwidth, and cooling systems.

- Reduces latency by minimising the distance between servers and the exchange's matching engine.

Algorithmic trading has become prevalent among leading brokerages in India, with a significant focus on DMA and HFT. Co-location facilities have further bolstered trading efficiency. Exchanges like NSE and BSE facilitate DMA and co-location services, attracting global players.

How to Start Algorithmic Trading in India

- To embark on an algorithmic trading program, one needs analytical and mathematical skills, programming proficiency, and an understanding of financial markets.

- Backtesting and strategy refinement are essential before live trading.

- Various courses and books cater to individuals keen on learning algorithmic trading.

Algorithmic Trading Roles in India

- Retail Algo Trading: With API-based trading available through discount brokers in India, individuals can engage in algorithmic trading. To begin, one must understand trading APIs, develop trading strategies, and conduct backtesting for validation.

- Proprietary Algo-Trading Firms: High-frequency trading (HFT) and large-scale algorithmic trading are conducted by proprietary trading firms. Operating with personal capital, individuals in these roles develop alpha-generating algorithms, potentially earning substantial bonuses.

- Institutional Algo-Trading Firms: Major brokers provide algo trading platforms for client trades. Responsibilities in these roles include designing execution and arbitrage algorithms for large-scale trading operations.

- Quant Analyst Roles: Financial intermediaries such as corporate investment advisors, portfolio management services (PMS), brokers, and mutual funds offer positions for data scientists. These roles involve analysing economic data to uncover valuable insights.

- Technical and Data Related Roles: Algo trading software has led to the employment of developers and data analysts for various functions, including algorithm development, data analysis, and system maintenance.

Regulations on Algorithmic Trading in India

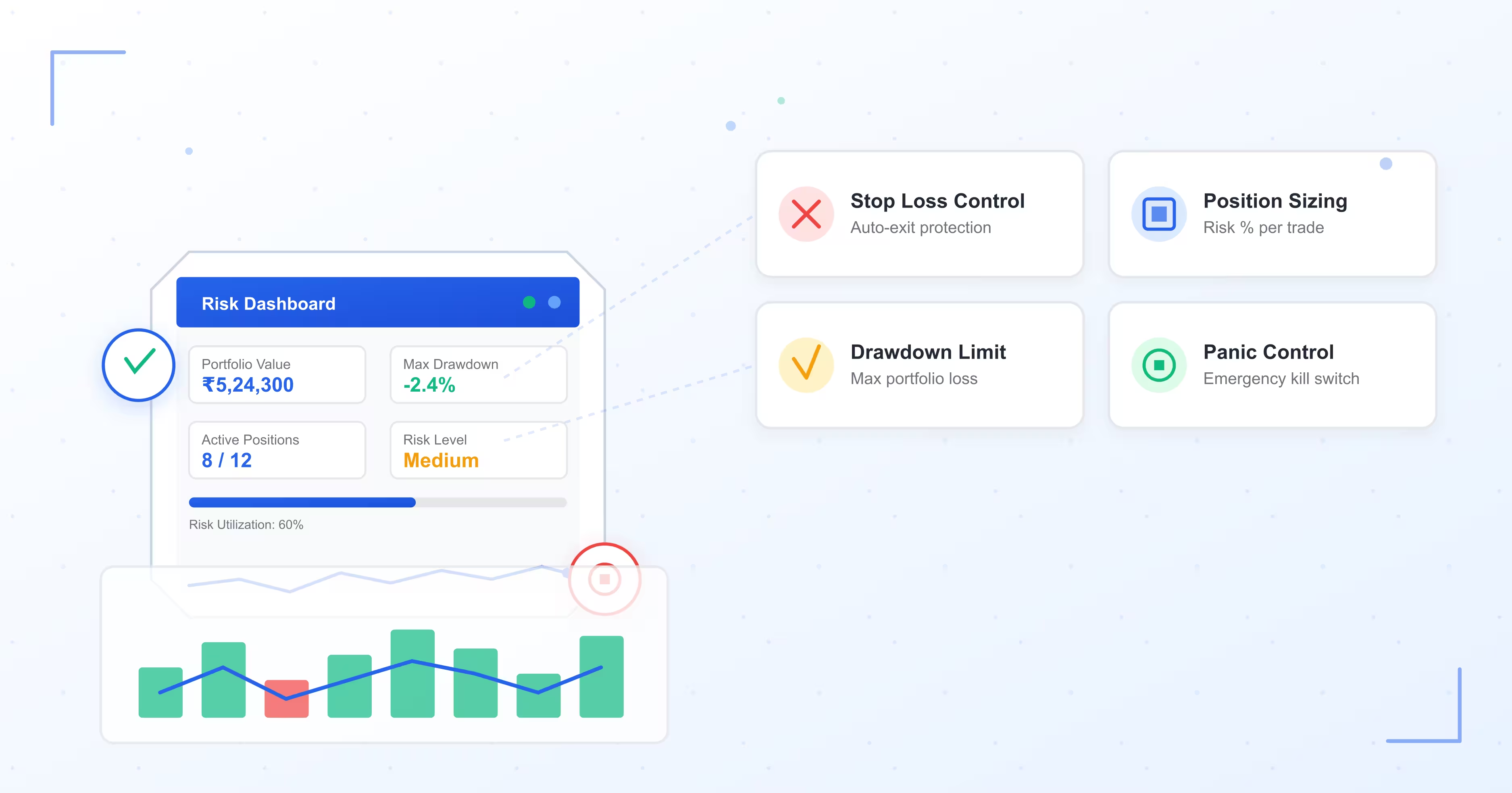

- SEBI mandates half-yearly audits for algorithmic trading firms, ensuring compliance with execution-related regulations and risk control measures specific to commodity markets.

- Audit requirements include maintaining logs for orders, trades, and control parameters.

Future of Algorithmic Trading in India

Algorithmic trading software is expected to witness continued growth in India, fostering market efficiency and liquidity. Predictions indicate substantial market share contributions from equities and a steady growth rate in the coming years. The equities market is expected to contribute $8.61 billion in the algorithmic trading market share by 2027, with a projected CAGR of 11.23 per cent between 2021–2026.

Technological Advancements

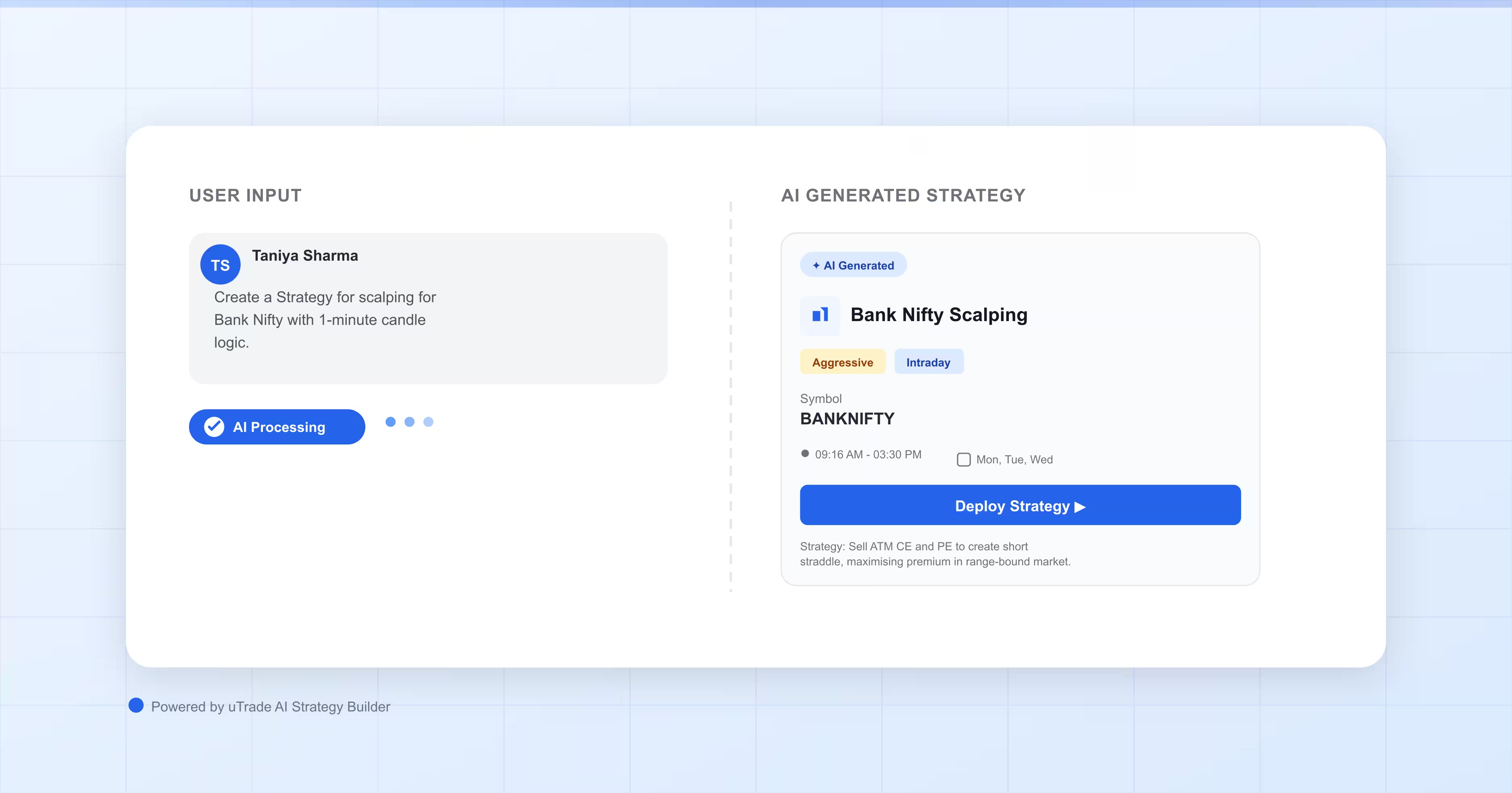

Ongoing advancements in technology, particularly in areas such as artificial intelligence (AI), machine learning (ML), and big data analytics, are expected to further fuel the growth of algorithmic trading in India. These technologies enable traders to develop more advanced trading strategies, analyse large datasets in real time, and make data-driven decisions with greater precision.

Regulatory Environment

Regulatory frameworks governing algorithmic trading are likely to evolve to accommodate the changing landscape of financial markets. Regulators such as the Securities and Exchange Board of India (SEBI) may introduce new guidelines or revise existing regulations to ensure the orderly functioning of algorithmic trading activities while addressing concerns related to market integrity, transparency, and investor protection.

Increased Adoption Across Market Segments

Algorithmic trading in India is no longer limited to institutional investors or large trading firms. With the advent of API-based trading platforms and the availability of algorithmic trading tools and resources, retail investors are increasingly embracing algorithmic trading strategies. This democratisation of algorithmic trading is expected to contribute to its widespread adoption across various market segments in India.

Global Integration

India's financial markets are becoming increasingly integrated with global markets, creating opportunities for cross-border trading and investment. Algorithmic trading firms in India are likely to leverage this trend by developing strategies that capitalise on international market movements and arbitrage opportunities, further driving the growth of algorithmic trading activities in the country.Algorithmic trading software has, indeed, revolutionised India's financial markets, offering efficiency, speed, and precision in trade execution. With continued advancements and regulatory oversight, algorithmic trading in India is poised for further growth and innovation in the Indian market landscape.