In the ever-evolving landscape of financial markets, predictive analysis has become a valuable tool for traders and investors seeking to anticipate future price movements and make informed decisions. One often-overlooked source of valuable data for such analysis is the historical options chain. By analysing past options data, via option payoff graphs and others, traders can gain insights into market sentiment, volatility expectations, and potential price trajectories. In this blog post, we'll explore how to effectively use historical options chain data for predictive analysis.

Understanding the Options Chain

Before understanding predictive analysis, it's crucial to understand what an options chain represents. An options chain is a list of all available options contracts for a particular underlying asset, including calls, puts, strike prices, and expiration dates. Each option contract provides the right, but not the obligation, to buy or sell the underlying asset at a specified price (strike price) before a certain date (expiration date).

Why Use Historical Options Chain Data?

Historical options chain data can offer valuable insights into:

- Market Sentiment: On algo trading platforms, by analysing the volume and open interest of specific options contracts, traders can gauge market sentiment and determine whether investors are bullish or bearish on the underlying asset.

- Volatility Expectations: Options prices reflect market expectations of future volatility. By examining historical volatility levels and implied volatility from options prices, traders can anticipate potential price swings and adjust their strategies accordingly.

- Price Trajectories: Patterns and trends in options data can provide clues about potential price trajectories and support/resistance levels for the underlying asset.

Steps to Use Historical Options Chain Data for Predictive Analysis

- Data Collection: Obtain historical options chain data, via option payoff graphs and others, for the desired underlying asset, including contract details, prices, volumes, open interest, and expiration dates. This data can typically be sourced from financial databases, brokerage platforms, or specialised options data providers.

- Data Cleaning and Preparation: Clean and organise the data to remove any inconsistencies or errors. Ensure that the data is formatted correctly and suitable for analysis.

- Market Sentiment Analysis: Analyse the volume and open interest of the call and put options, via option payoff charts, to gauge market sentiment. High call volume and open interest relative to put options may indicate bullish sentiment, while high put volume and open interest may suggest bearish sentiment.

- Volatility Analysis: Calculate historical volatility levels using past options prices and compare them with implied volatility levels derived from current options prices. Identify any discrepancies or trends that may indicate potential changes in volatility expectations.

- Pattern Recognition: Identify recurring patterns, trends, or anomalies in the options chain data that may provide insights into potential price trajectories, support/resistance levels, or upcoming market events.

- Predictive Modeling: Utilise statistical models, payoff charts via algorithmic trading, or quantitative techniques to forecast future price movements based on the analysed options chain data. Incorporate other relevant market data, indicators, or economic factors to enhance the predictive accuracy of the model.

Considerations When Using Historical Options Chain Data

- Data Accuracy and Consistency: Ensure the historical options chain data is accurate, consistent, and free from errors or omissions that could skew analysis and conclusions.

- Changing Market Dynamics: Recognise that past market conditions and dynamics may differ from current or future conditions, limiting the predictive power of historical data.

- Over-reliance on Past Patterns: Avoid placing excessive reliance on past patterns or trends in options data as markets are influenced by various unpredictable factors that may not repeat.

- Implied vs. Actual Volatility: Understand the difference between implied volatility derived from options prices and actual realised volatility, as discrepancies can impact predictive accuracy.

- Limited Historical Data: Be mindful of the limitations of available historical options chain data, which may not encompass all relevant market conditions, events, or trading activities.

- Model Assumptions and Biases: When employing predictive models or algorithms on algo trading platforms, be aware of inherent assumptions, biases, or limitations that could affect the reliability and validity of forecasts.

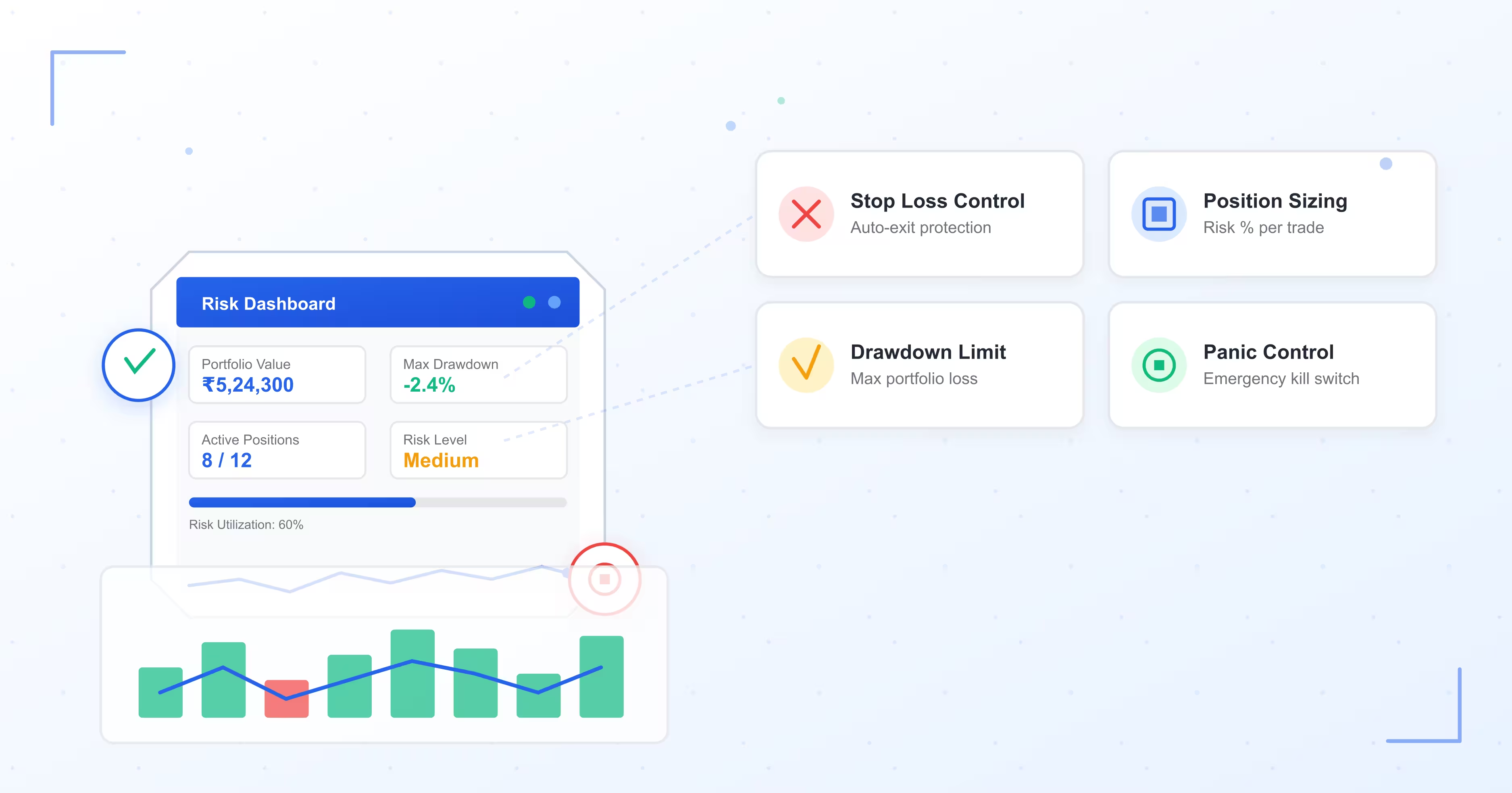

- Risk Management: Always incorporate robust risk management practices when utilising historical options chain data for trading decisions to mitigate potential losses and protect capital.

Alternative Methods for Predictive Analysis

Predictive analysis plays a pivotal role in financial markets, offering valuable insights to traders and investors. While historical options chain data is one method, various alternative approaches can also be employed to forecast market trends and make informed decisions.

- Technical Analysis: Utilise chart patterns, indicators, and trend analysis to forecast future price movements based on historical price and volume data, like on platforms like uTrade Algos.

- Fundamental Analysis: Evaluate economic data, company financials, industry trends, and market news to predict asset valuations and investment opportunities.

- Sentiment Analysis: Analyse social media, news articles, and market commentary to gauge investor sentiment and its potential impact on market behaviour.

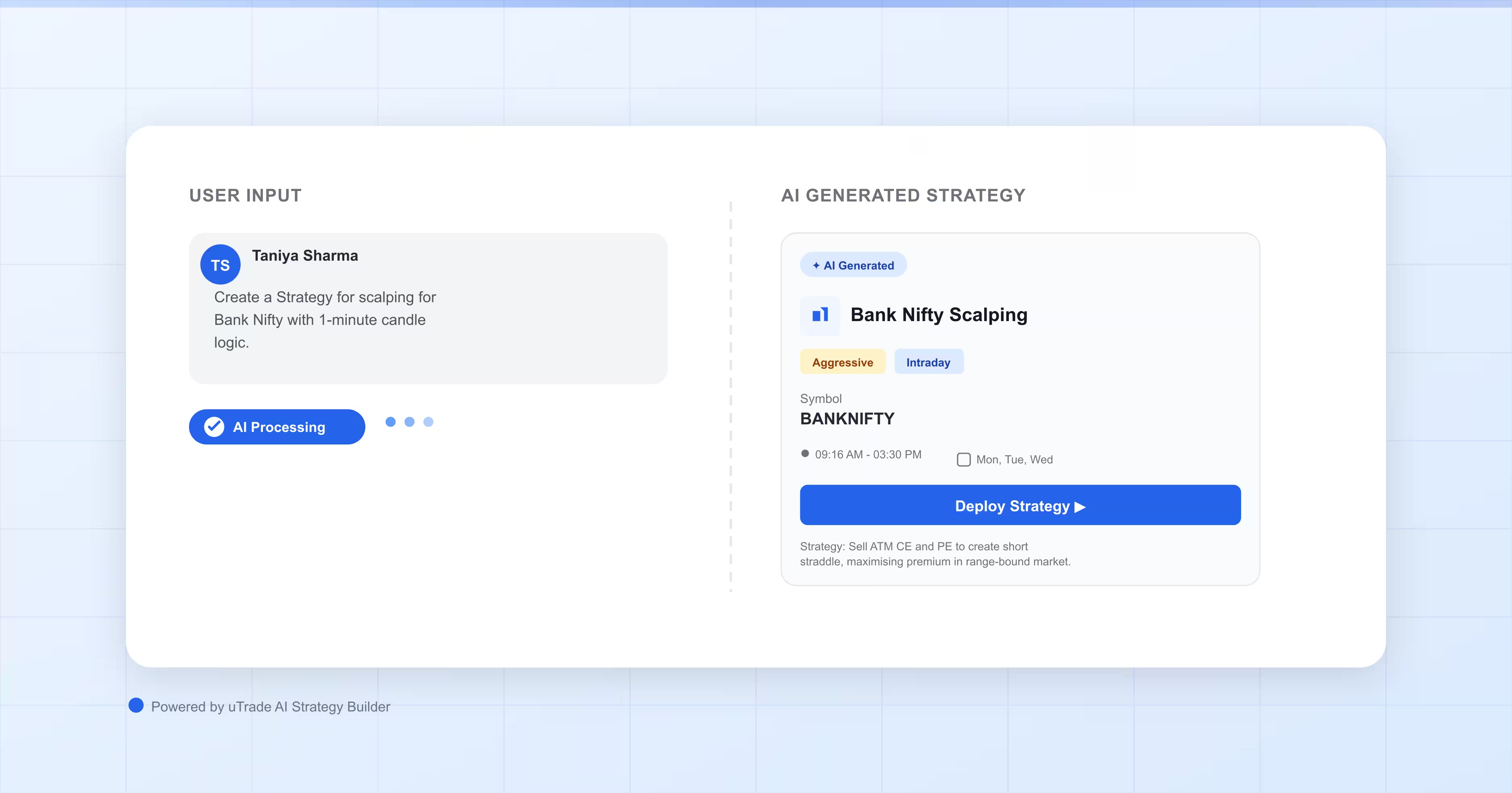

- Machine Learning Algorithms: Implement advanced algorithms and predictive models using vast datasets to identify patterns, trends, and anomalies for forecasting.

- Econometric Models: Apply statistical and mathematical techniques to economic data and market variables to develop forecasting models based on historical relationships and correlations.

- Quantitative Analysis: Employ mathematical and statistical methods in payoff charts via algorithmic trading, to analyse market data, identify patterns, and develop trading strategies based on quantitative factors and algorithms.

- Event-driven Analysis: Monitor and analyse specific events, announcements, or news releases that could impact asset prices and market movements.

When it comes to algo trading in India and across the world, harnessing the power of historical options chain data for predictive analysis, via option payoff charts or others, or using other predictive analysis tools, can provide traders and investors with valuable insights into the market sentiment, volatility expectations, and potential price trajectories. By employing a systematic approach to analysing options data, traders can make more informed decisions, mitigate risks, and capitalise on opportunities in the financial markets.