In recent years, the landscape of financial markets has undergone a significant transformation with the rise of algorithmic trading on algo trading platforms in India like uTrade Algos. Traditional methods of trading, once dominant, are now being challenged by algo trading in India comprising sophisticated algorithms and high-frequency trading strategies. This shift begs the question: Is algorithmic trading on algo trading platforms surpassing traditional methods, putting traditional traders at a disadvantage?

Introduction to Algorithmic Trading

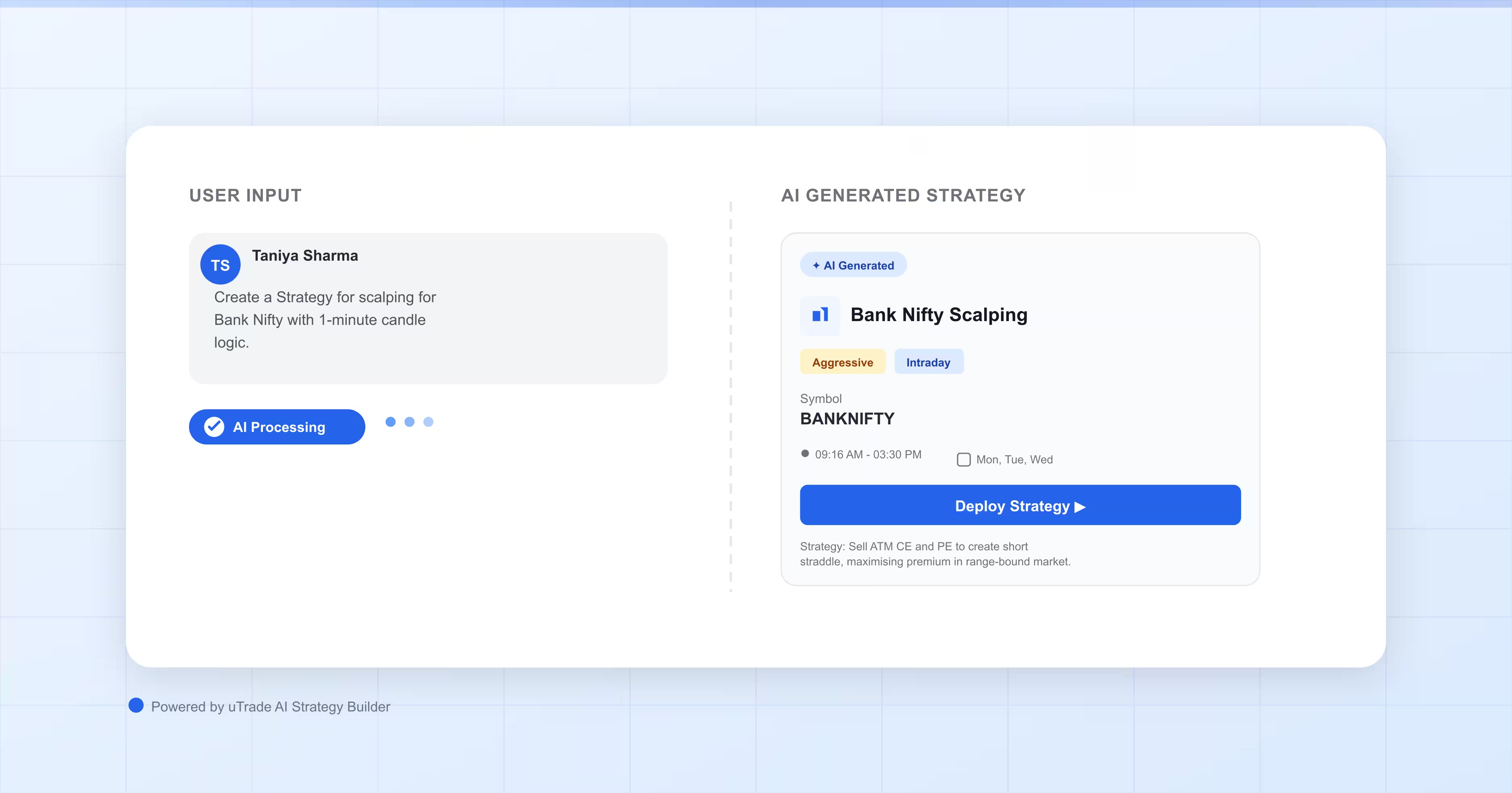

Algorithmic trading, also known as algo trading or automated trading, involves the use of computer programs to execute trading strategies with speed and precision. These algorithms analyse vast amounts of data, identify patterns, and execute trades based on predefined rules and parameters. Algorithmic trading can encompass various strategies, including statistical arbitrage, trend following, and market making.

The Rise of Algorithmic Trading

Advancements in Technology

Technological progress has been a driving force behind the proliferation of algo trading.

- Over the past few decades, computing power has increased exponentially, while the cost of hardware has decreased significantly. This has enabled traders to deploy sophisticated algorithms capable of processing vast amounts of data with unprecedented speed and efficiency.

- Additionally, improvements in network connectivity, such as the widespread adoption of high-speed internet and the development of dedicated trading networks, have further facilitated the rapid transmission of data between trading platforms like uTrade Algos and exchanges.

Access to Market Data

One of the key advantages of algorithmic trading is the access to real-time market data and news feeds.

- Algorithmic traders have access to a wealth of information, including price quotes, order book data, economic indicators, corporate announcements, and news articles, all of which can be incorporated into trading algorithms to make informed decisions.

- With the advent of sophisticated data analytics tools and machine learning algorithms, traders can sift through vast amounts of data to identify patterns, correlations, and anomalies that may signal trading opportunities or risks. By leveraging real-time market data, algorithmic traders can react swiftly to changing market conditions, adjust their trading strategies in response to new information, and capitalise on market inefficiencies before they are exploited by competitors.

Reduced Costs

Another significant benefit of algorithmic trading is the reduction in trading costs.

- Traditional trading methods often involve human intervention at various stages of the trading process, from order placement to execution and settlement.

- This human involvement not only introduces the potential for human error but also incurs costs in the form of salaries, commissions, and overhead expenses. In contrast, algorithmic trading automates many aspects of the trading process, minimising the need for human intervention and reducing labour costs.

- Furthermore, algorithmic trading algorithms are designed to optimise trade execution by minimising market impact, slippage, and transaction costs, resulting in cost savings for traders.

Increased Liquidity

High-frequency trading (HFT) algorithms play a crucial role in enhancing market liquidity. These algorithms are designed to provide continuous buy and sell orders in the market, effectively acting as market makers.

- By continuously quoting bid and ask prices and executing trades at lightning-fast speeds, HFT algorithms narrow bid-ask spreads, reduce price volatility, and improve price discovery. This increased liquidity benefits all market participants by providing tighter spreads, deeper order books, and more efficient price formation.

- Moreover, increased liquidity reduces the cost of trading and enhances market efficiency, ultimately benefiting investors and promoting economic growth.

- However, it's worth noting that while HFT algorithms contribute to market liquidity, they also raise concerns about market stability, fairness, and transparency, which have prompted regulatory scrutiny and calls for greater oversight of algorithmic trading activities.

Advantages of Algorithmic Trading

Algorithmic trading offers several advantages over traditional methods:

- Speed: Algorithmic platforms like uTrade Algos can execute trades at speeds far beyond human capabilities, enabling traders to capitalise on fleeting market opportunities.

- Accuracy: Algorithms execute trades based on predefined rules without succumbing to emotional biases, leading to more consistent and disciplined trading.

- Scalability: Algo trading in India and across the world can be scaled up or down easily to accommodate different trading volumes and asset classes.

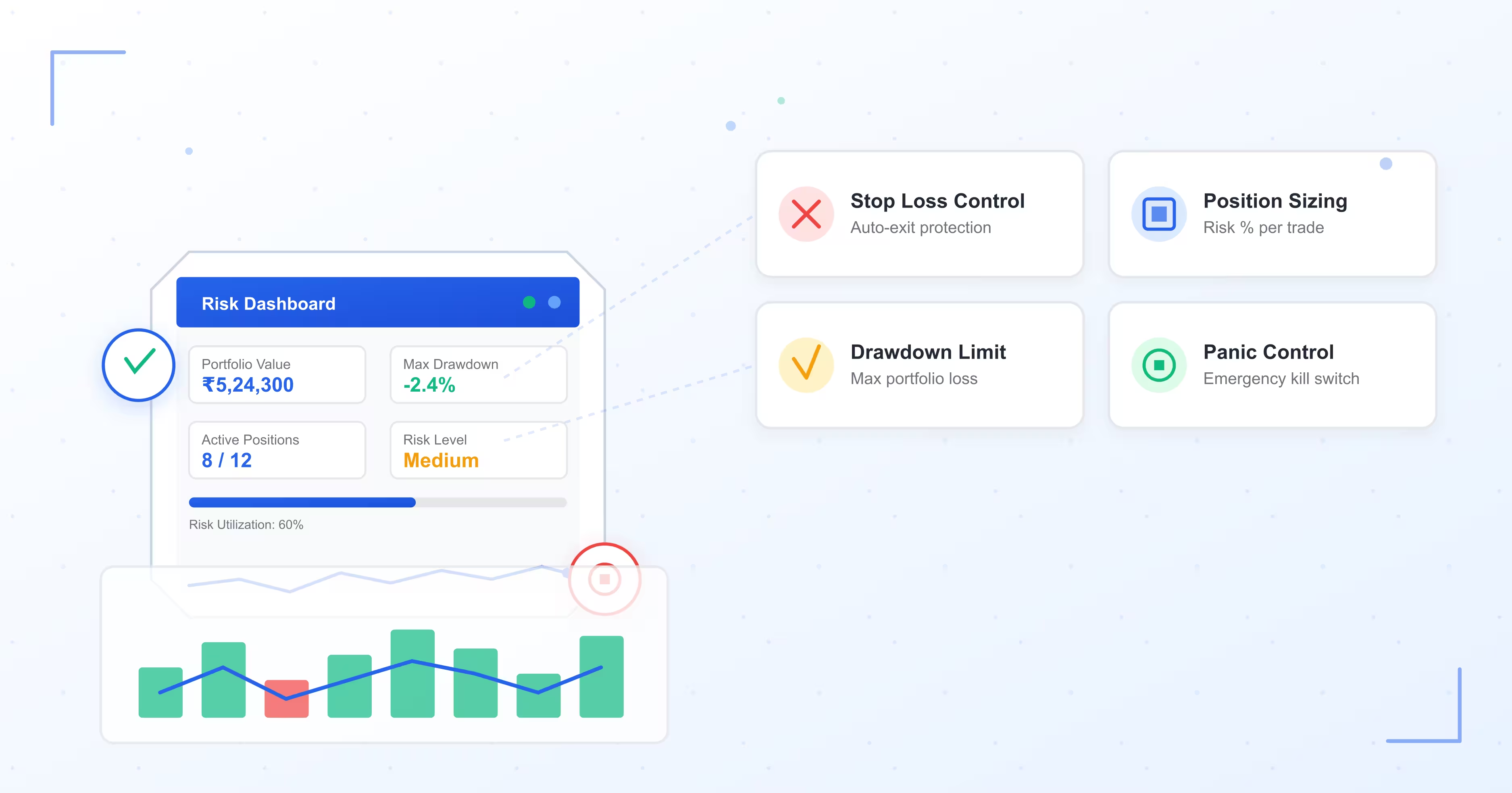

- Risk Management: Automated risk management features can mitigate the impact of adverse market movements and prevent large losses.

Challenges Faced by Traditional Traders in the Age of Algorithmic Tradin

While algorithmic trading programs present numerous benefits, traditional traders face several challenges:

- Competitive Disadvantage: Traditional traders may struggle to compete with algorithmic traders in terms of speed and efficiency.

- Adaptability: Adapting to rapidly evolving market conditions and technological advancements can be daunting for traditional traders accustomed to manual trading methods.

- Learning Curve: Mastering algorithmic trading on algo trading platforms requires proficiency in programming, quantitative analysis, and financial modelling, posing a steep learning curve for traditional traders.

- Regulatory Concerns: Regulatory scrutiny surrounding algorithmic trading, particularly about market manipulation and systemic risk, adds complexity and compliance costs for traditional traders.

Balancing Tradition and Algorithmic Innovation

Despite the rise of algorithmic trading, traditional methods still hold relevance in the financial markets. Human traders bring qualitative insights, intuition, and contextual understanding that algorithms may lack. Moreover, certain trading strategies, such as value investing and fundamental analysis, remain effective in generating long-term returns.

To remain competitive in an increasingly algorithmic landscape, traditional traders can consider the following strategies:

- Education and Training: Invest in education and training programs to enhance skills in algo trading, quantitative finance, and risk management.

- Hybrid Approaches: Adopt hybrid trading approaches that combine the strengths of both algorithmic and discretionary trading methods, leveraging human judgment alongside algorithmic execution.

- Collaboration and Partnerships: Collaborate with technology providers, quantitative analysts, and algorithmic trading firms to access cutting-edge tools and strategies.

- Diversification: Diversify trading strategies and asset classes to mitigate risks and adapt to changing market dynamics.

While algorithmic trading programs have undoubtedly disrupted traditional trading methods, it is not a panacea and poses challenges for traditional traders. However, by embracing innovation, leveraging technology, and maintaining a commitment to continuous learning, traditional traders can navigate this evolving landscape and remain competitive. Ultimately, the synergy between tradition and innovation holds the key to success in the dynamic world of financial markets.