Defining Risk Management

Risk management in trading refers to the systematic process of identifying, analysing, and mitigating potential risks associated with financial trading activities.

- It involves strategies and measures aimed at preserving capital, reducing potential losses, and ensuring the overall stability of a trading portfolio.

- The goal of risk management in trading is to maintain a balance between potential returns and exposure to market fluctuations, helping traders make informed decisions and navigate uncertainties effectively.

Algorithmic risk management in trading, on online trading platforms like uTrade Algos, involves systematically identifying and mitigating potential risks linked to automated trading strategies, aiming to enhance reliability and efficiency while minimising potential losses.

Various Risks in Trading

Trading involves various risks that traders must manage effectively to ensure successful outcomes. These risks can be categorised into traditional risks and those that have gained prominence with the advent of automated trading:

Traditional Risks

- Market Risk: This risk stems from broader market failures caused by factors like social, political, or economic issues. Measuring volatility aids in managing this risk.

- Credit Risk: Linked to the creditworthiness of individuals, corporations, or governments, this risk influences funding options available to traders.

- Liquidity Risk: It pertains to the ease of converting assets into cash without significant price impact. Having liquid assets helps manage liquidity risk.

- Regulatory Risk: Changes in laws and regulations can have a profound impact on trading strategies.

Algorithmic Trading Risk Management

- Operational Risk: Arising from internal process or system/network failures, operational risk includes technology-related risks, absence of structured policies, and errors in various processes.

- Scalability Risk: Traders face the challenge of scaling up during difficult situations, which can affect their profit potential.

- Technological Risk: Malfunctions and human errors related to technology can disrupt trading activities.

- Human Resource Risk: The employment of qualified personnel in finance and computer science is crucial for the success of algorithmic trading.

These risks underscore the importance of robust risk management strategies to navigate the complexities of trading effectively and ensure sustainable success.

The Need for Risk Management in Algorithmic Trading

The speed, complexity, and reliance on technology in algorithmic trading bring about unique risks that necessitate robust risk management practices. Here's why risk management is essential in algorithmic trading:

Complex Algorithms and Unforeseen Events

Algorithmic trading strategies are built on intricate algorithms that analyse vast amounts of data and execute trades with precision. Despite rigorous testing, these algorithms can sometimes behave unexpectedly due to market anomalies or events not accounted for in their programming. Risk management protocols help identify and respond to algorithmic anomalies swiftly, preventing excessive losses.

High-Frequency Trading (HFT) Risks

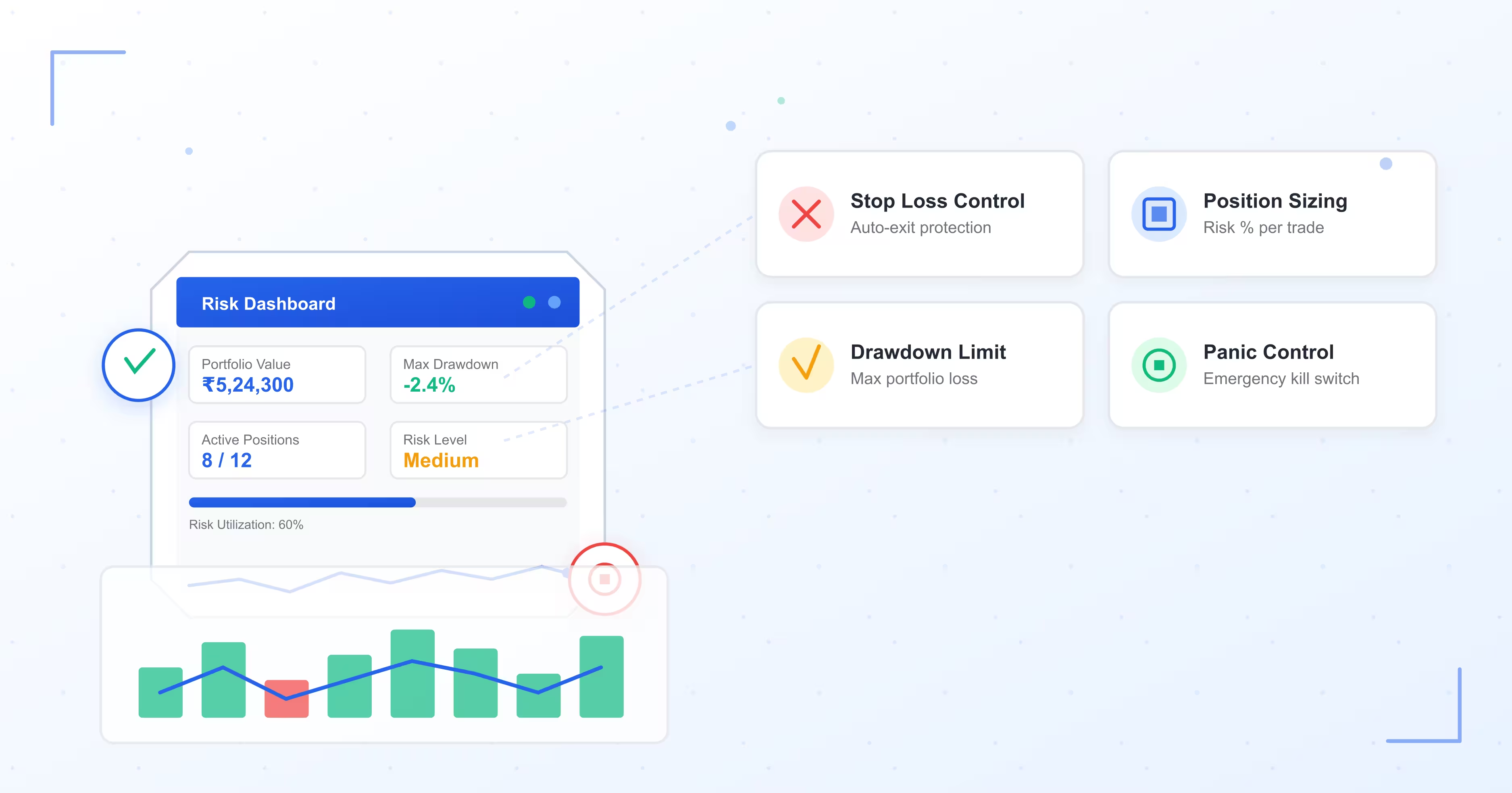

High-frequency trading involves executing a large number of trades in a fraction of a second. While this strategy aims for quick profits, it exposes traders to risks where markets experience rapid and severe price fluctuations. Risk management tools can trigger automatic pauses or halts in trading during extreme market volatility, safeguarding against uncontrollable losses.

System Glitches and Failures

Technology glitches, connectivity issues, or system failures can disrupt algorithmic trading operations, leading to unintended trades or losses. Robust risk management strategies incorporate fail-safes and circuit breakers to halt trading if technical glitches occur, preventing potentially catastrophic financial consequences.

Regulatory Compliance

Algorithmic trading is subject to various regulatory frameworks to ensure market fairness, transparency, and investor protection. Failure to comply with regulations can result in substantial fines and reputational damage. Effective algo risk management includes measures to ensure that trading algorithms adhere to regulatory guidelines, avoiding legal pitfalls.

Market Liquidity and Slippage

Algorithmic trading's speed and frequency can lead to large trade volumes that impact market liquidity. Illiquid markets can result in slippage, where executed trades differ significantly from intended prices. Risk management systems employ safeguards to mitigate the impact of slippage and manage liquidity risks effectively.

Black Swan Events

Unpredictable events, often referred to as ‘black swan’ events, can have a profound impact on financial markets. These events, such as geopolitical crises or natural disasters, can trigger extreme market volatility and disrupt trading strategies. Risk management strategies include scenario analysis and stress testing to assess algorithmic performance under extraordinary circumstances.

Overfitting and Data Bias

Algorithmic strategies are developed based on historical data, and there's a risk of overfitting, where strategies perform well in historical testing but fail in live markets due to changing conditions. Risk management involves continuous monitoring and adjustment of algorithms to prevent overfitting and mitigate the influence of data biases.

Human Errors and Oversight

Even with advanced algorithms, human oversight is necessary for monitoring and adjusting trading strategies. Risk management practices include real-time monitoring by experienced traders who can intervene if algorithms deviate from expected behaviour or market conditions change unexpectedly.

Achieving Effective Risk Management

Implementing effective algorithmic risk assessment practices in algorithmic trading involves several key steps:

- Knowledge: Equipping yourself with the necessary knowledge is paramount. Understand the requirements for seamless strategy execution to ensure uninterrupted trading operations.

- Setup: Create a robust setup encompassing technology, hardware, software, and infrastructure. A well-equipped setup contributes significantly to maintaining sound risk management practices.

- Collaborative Team: If working within a team, establish a reliable and skilled team structure. Delegate responsibilities to different teams to ensure comprehensive risk management adherence.

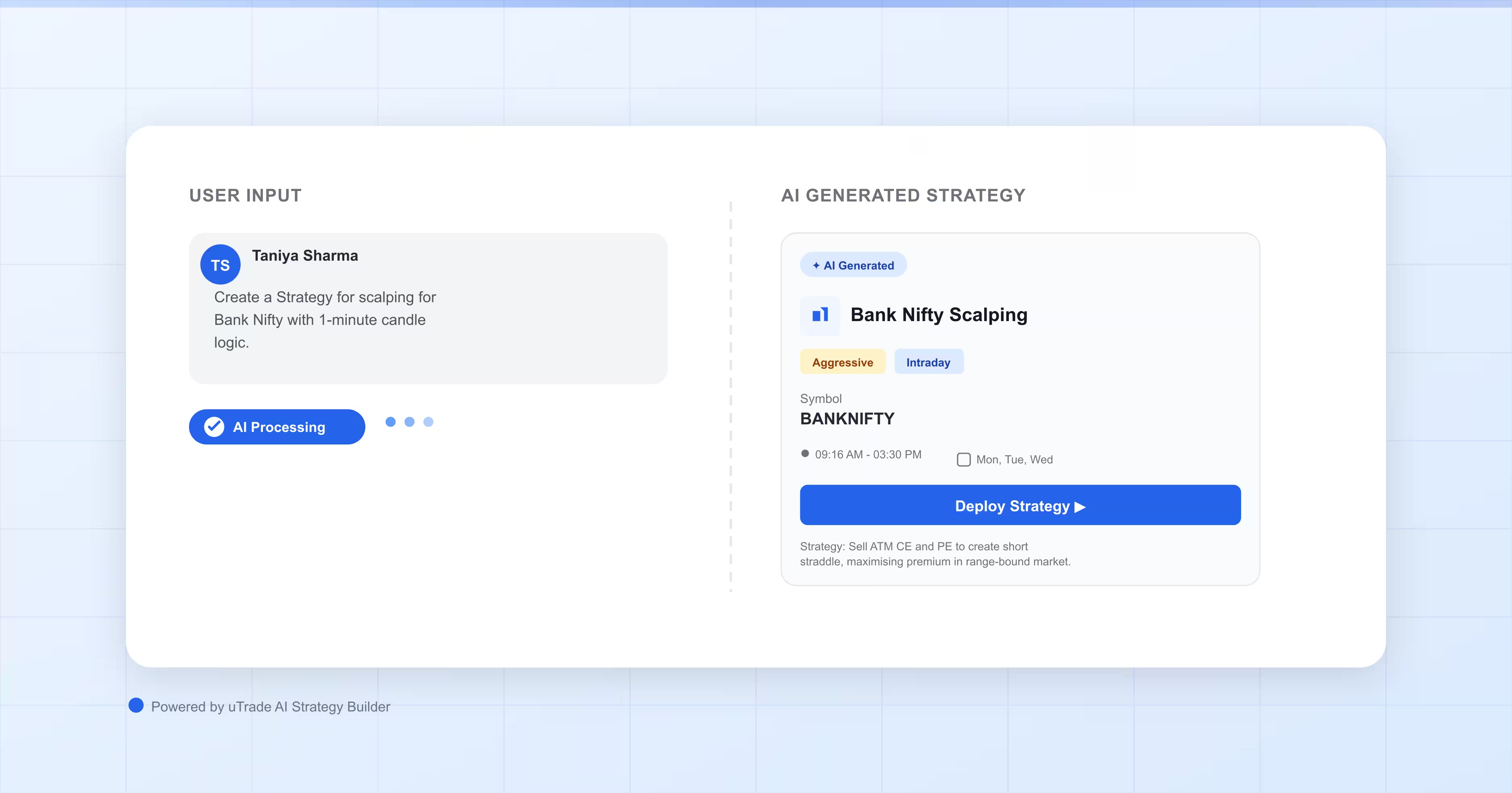

- Utilising Artificial Intelligence (AI): Leverage AI, particularly Machine Learning (ML), to enhance risk management. Employ machine learning models for tasks like reviewing potential employees' backgrounds, monitoring productivity, and ensuring regulatory compliance.

- Monitoring Productivity: Regularly monitor employee productivity to ensure efficient performance in line with risk management protocols.

- Regulatory Compliance: Ensure that employees adhere to government regulations governing algorithmic trading practices. Compliance is crucial to maintaining ethical and legal trading practices.

Ultimately, securing sufficient capital is vital to support the infrastructure, technology, and expertise needed for effective risk management practices. By following these steps, algorithmic traders can establish a strong foundation for managing risks and achieving sustainable success in their trading endeavours

How to Reduce Risks?

Risk management revolves around loss aversion, aiming to maximise long-term portfolio profitability while minimising risks. Addressing these points can help build an effective risk management strategy:

- Drawdown Limit: Set an appropriate stop loss to exit a position when unrealised profit/loss falls below a threshold. Balance the stop loss value to prevent early selling and missed profitable opportunities.

- Leverage Optimisation: Determine optimal leverage for your portfolio. Use the Kelly Criterion for leverage calculation, but consider using half-Kelly to avoid overestimating leverage and potential bankruptcy.

- Portfolio Diversification: Optimise your portfolio by including instruments with low correlation, enhancing forecast accuracy and minimising risk.

- Rebalance Frequency: Choose a secure rebalance frequency to manage trading costs. A monthly rebalance maintains returns while controlling turnover.

- Risk Indicators: Monitor leading indicators like volatility index for increased market risk periods. Avoid risky trading periods during high volatility, but beware of data-snooping bias while selecting indicators.

- Continuous Updates: Keep updating prices and stock information to limit leverage and losses as planned. Use the most recent estimate of volatility for initial trade size calculations.

- Value at Risk (VaR): Utilise VaR to estimate potential losses in a portfolio over a specific period with a given level of confidence. However, recognise VaR's assumptions and limitations, including its inability to account for extreme events.

- Education and Knowledge: Gain a deep understanding of algorithmic trading, market dynamics, and trading strategies. Knowledge empowers you to make informed decisions and anticipate potential risks.

- Start Small: Begin with a small portion of your capital for algorithmic trading. This reduces the overall exposure and potential losses during the learning phase.

- Backtesting: Thoroughly test your trading strategy using historical data before deploying it in live markets. Backtesting helps identify flaws and weaknesses in your strategy.

- Market Conditions: Be aware of changing market conditions. Algorithmic strategies that work well in one market condition might perform poorly in another.

- Simulation: Before deploying your strategy in live markets, run it in a simulated environment to gauge its performance without risking real capital.

The complexities of algorithmic trading demand a comprehensive approach that addresses various types of risks. By staying informed, employing advanced tools like artificial intelligence, and adhering to proven risk management principles, market participants can navigate the dynamic landscape of algorithmic trading with greater confidence. Give algo trading a shot with easy-to-use features on uTrade Algos.