The landscape of financial markets in India has been significantly transformed by the integration of advanced technologies into trading practices. One of the most prominent and impactful advancements is the rise of algorithmic trading. This blog aims to explore the profound influence of technology on the algorithmic trading platform in the Indian financial markets, highlighting its evolution, benefits, challenges, and prospects.

Evolution of Algorithmic Trading in India

India's financial markets have undergone a substantial shift from traditional manual trading to algo trading, primarily driven by technological advancements.

- The introduction of electronic trading platforms, like uTrade Algos, high-speed internet connectivity, and the development of sophisticated trading algorithms have revolutionised how trading is executed in Indian stock exchanges.

- The advent of algorithmic trading in India gained momentum in the early 2000s, following global trends. Initially, it was predominantly used by institutional investors, hedge funds, and large financial institutions due to its complexity and infrastructure requirements. However, over time, technological advancements and regulatory changes have made algorithmic trading more accessible to retail investors and smaller trading firms in India.

Impact of Technology on Algorithmic Trading

Speed and Efficiency

- Technology has enabled algorithmic trading systems to execute trades at incredibly high speeds, leveraging automation to place orders, monitor markets, and execute complex strategies within milliseconds. This speed advantage has significantly reduced transaction costs and enhanced market liquidity.

- Efficiency has grown with the advent of technology as well. For example, uTrade Algos provides users with the capability to assess their strategy's historical performance accurately through precise historical data and its proprietary algorithmic engine. Prior to engaging in live market trading, users can conduct comprehensive backtesting of their strategies to gauge their hypothetical performance within specific time frames. This allows for informed decision-making and a deeper understanding of how the strategy might have fared in past market conditions before implementation in live trading environments.

Market Liquidity and Efficiency

- The Algorithmic trading platform has contributed to improved market liquidity and efficiency in Indian markets by increasing trading volumes, tightening bid-ask spreads, and enhancing price discovery mechanisms.

- Together with this, the interactive payoff graph feature on uTrade Algos brings customisation to your fingertips! You need to define your target date and the expected spot price for that date to tailor the payoff graph according to your unique trade conditions. This functionality allows you to gain a comprehensive insight into how alterations in these parameters could impact your potential trading results, empowering you with a deeper understanding of your trade's potential outcomes.

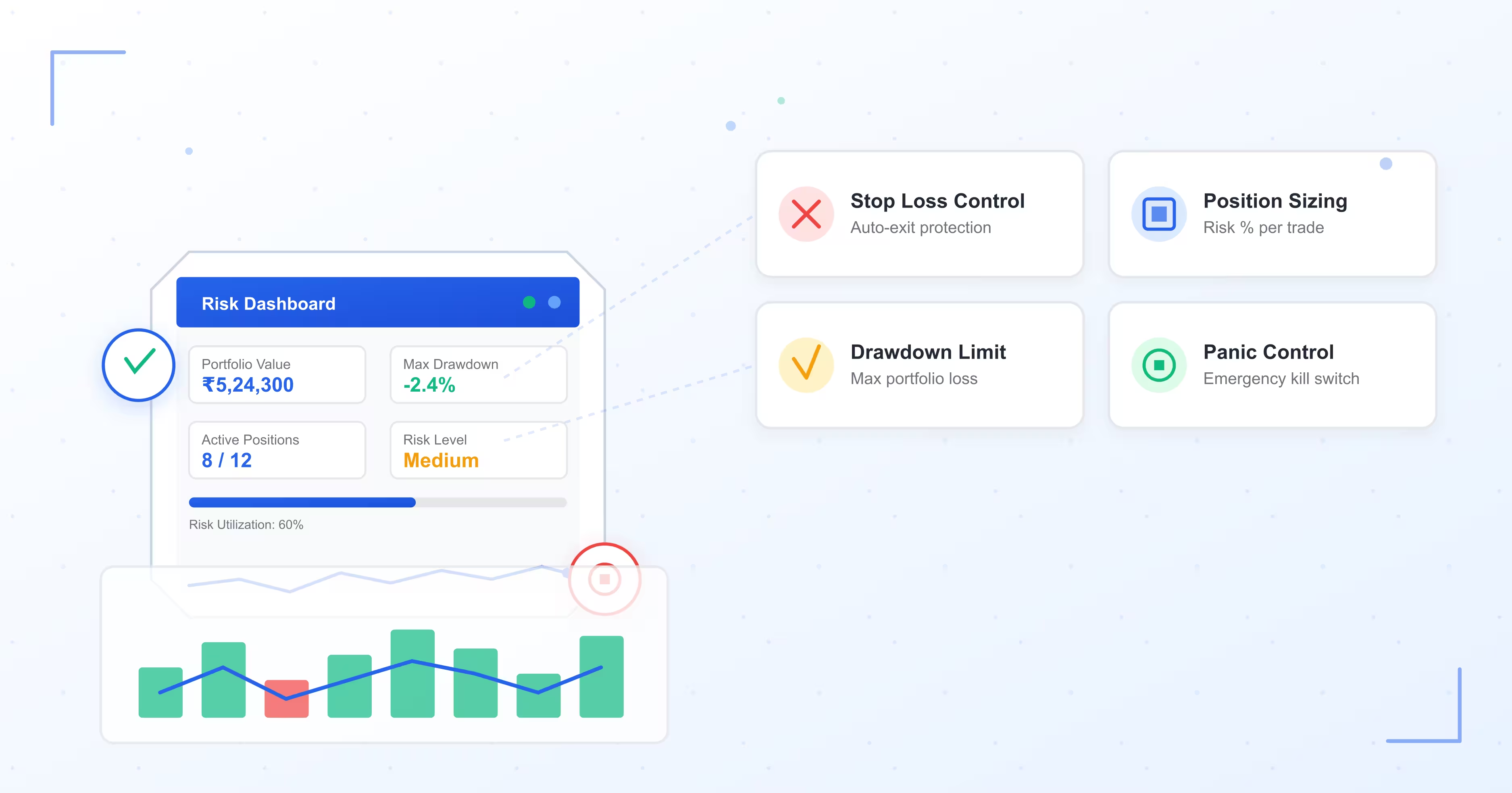

Enhanced Risk Management

Advanced technological tools and algorithms enable traders to implement sophisticated risk management strategies by setting predefined risk parameters, implementing stop-loss mechanisms, and managing portfolio exposures more effectively.

Accessibility and Inclusivity

- Technology-driven platforms have democratised access to algorithmic trading, allowing retail investors and smaller firms in India to participate in the market on equal footing with larger institutions. This has widened market participation and diversified trading strategies.

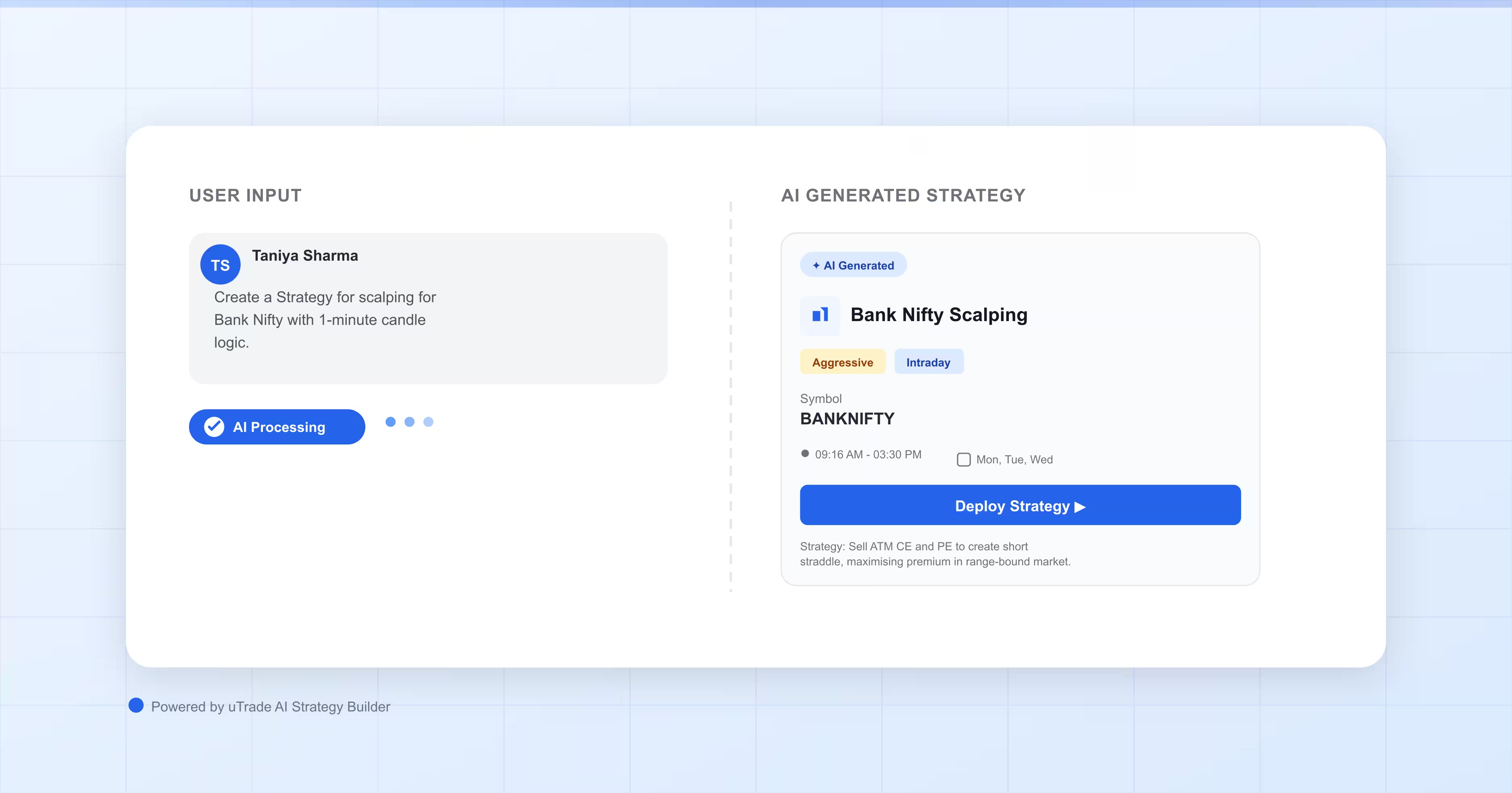

- For instance, The advent of no-code solutions in various trading platforms, such as uTrade Algos, has democratised algorithmic trading, enabling even non-experts to engage in this sophisticated practice.

Challenges and Considerations

Despite its benefits, the algorithmic trading program in India is not without challenges.

- Technological Challenges: System failures or connectivity issues can disrupt trades; robust infrastructure and rapid response mechanisms are vital for minimising downtime and ensuring reliability.

- Regulatory Complexity: Navigating evolving regulations demands expertise and resources; adherence to compliance standards is essential to align trading practices with legal frameworks.

- Market Manipulation Risks: Mitigating spoofing threats requires robust surveillance tools and real-time monitoring for maintaining market integrity against manipulative practices.

- Continuous Monitoring and Adaptation: Adapting algorithms to market changes is crucial; ongoing optimisation ensures responsiveness and effectiveness in dynamic trading environments.

Future Outlook

The future of algorithmic trading in India appears promising with the continuous integration of cutting-edge technologies such as artificial intelligence, machine learning, big data analytics, and blockchain.

- Artificial intelligence and machine learning algorithms will empower traders to analyse vast amounts of data rapidly, uncovering nuanced patterns and trends that human analysis might overlook.

- This enhanced data processing capability will aid in crafting more accurate predictive models, resulting in more informed and effective trading decisions.

- Moreover, the integration of big data analytics will facilitate a deeper understanding of market behaviour and trends, allowing traders to make more data-driven and strategic choices.

- The utilisation of blockchain technology is anticipated to enhance transparency, security, and efficiency in trade settlements and transaction processes, reducing counterparty risks and streamlining trade execution.

- Ultimately, these technological advancements are expected to not only optimise trade execution processes but also revolutionise risk management strategies, making algorithmic trading in India more robust, efficient, and adaptable to evolving market conditions.

Technology has been instrumental in reshaping the landscape of the algorithmic trading program in India. As the financial markets continue to evolve, the integration of advanced technologies looks likely to play a pivotal role in driving further innovation, efficiency, and inclusivity in algo trading, making it an integral part of India's financial ecosystem.

Disclaimer: This blog is for informational purposes only and does not constitute financial advice. Readers are encouraged to conduct thorough research and consult financial experts before making any investment decisions.