The Role of Data

Data forms the cornerstone of trading activities. It enables the visualisation of market situations through charts, facilitating a comprehensive understanding. From this point of comprehension, traders can strategise and take actionable steps.

Sources and Costs

The acquisition of market data typically comes with a cost. Exchanges, data providers, and brokers offer diverse data feeds, ranging from costly to free, based on the type of data required and the trading instrument involved.

For instance, direct purchase of high-quality stock data from exchanges usually incurs significant expenses. However, data providers and some brokers offer more economical options or include data as part of their service packages. Futures data tends to be expensive, while crypto data is often accessible at no cost. Recognising data as the fuel driving trading activities is crucial.

Varieties of Data

- Real-Time Data: Essential for swift trading styles like scalping and day trading, enabling quick responses to market changes. Low-latency real-time data is imperative for seizing very short-term trading opportunities, providing a potential edge over competitors.

- Delayed Data: Offers updates at intervals of 15 minutes or more. Suited for position traders operating across weeks or months, providing a more cost-effective alternative to real-time feeds.

- Historical Data: Offers insights into past price movements, aiding analysis and facilitating back-testing for traders.

Role of Real-Time Market Data in Trading

Swift Decision-Making

One of the primary ways real-time market data empowers traders is by providing instantaneous access to critical information. In a fast-paced trading environment, where market conditions can shift rapidly, having up-to-the-second data is invaluable. This data empowers traders to swiftly analyse trends, track price movements, and identify emerging opportunities, allowing for timely and precise decision-making.

Enhanced Market Insights

Real-time data acts as a window into the heartbeat of the market. It offers traders a real-time view of market sentiment, trade volumes, and price movements across various financial instruments. This invaluable insight enables traders to understand market dynamics, recognise patterns, and anticipate potential market movements, thereby enhancing their ability to strategise effectively.

Efficient Risk Management

Empowerment through real-time data extends to effective risk management. By continuously monitoring live market feeds, traders can promptly assess their positions, track changes in asset values, and react swiftly to adverse market developments. This ability to react in real-time aids in implementing risk mitigation strategies promptly, minimising potential losses.

Access to Diverse Trading Strategies

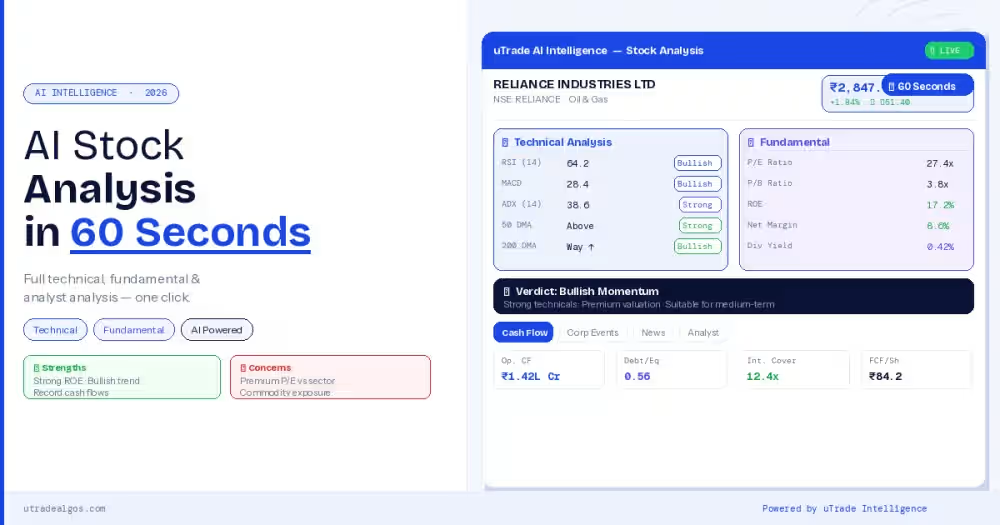

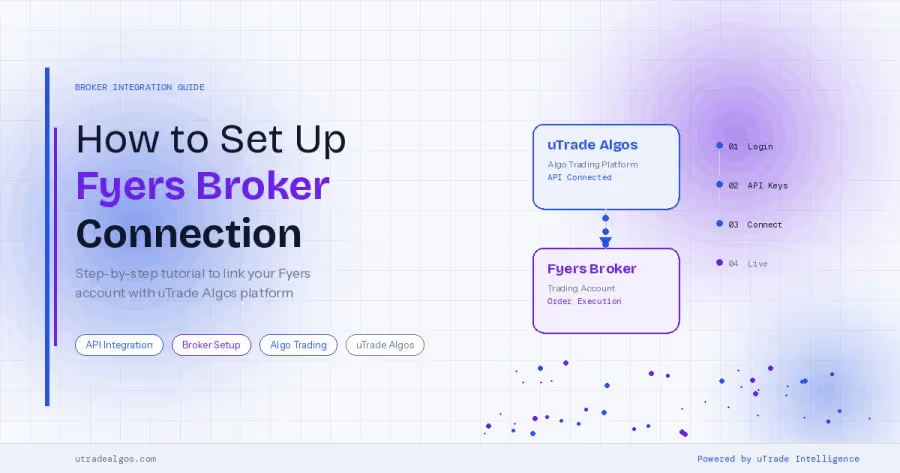

Real-time data empowers traders to experiment with and execute diverse trading strategies. From scalping to day trading and swing trading to algorithmic trading on platforms like uTrade Algos, having access to instantaneous market data allows traders to adopt strategies that capitalise on fleeting opportunities, thus diversifying their approaches to the market.

Integration into Trading Tools and Systems

Another facet of empowerment lies in the seamless integration of real-time data into various trading tools and systems. Modern trading platforms and algorithmic trading systems leverage real-time data to provide traders with sophisticated analytical tools, customisable indicators, and automated trading functionalities. This integration enhances traders' capabilities and efficiency in executing trades aligned with their strategies.

Continuous Learning and Adaptability

Real-time data serves as a rich source for continuous learning and adaptation. Traders can analyse historical real-time data to refine trading models, conduct back-testing, and improve their strategies. This iterative process allows traders to adapt and evolve in response to changing market conditions, enhancing their long-term success.

Risks of Real-Time Data in Algo Trading Software

Integration of real-time data into automated algo trading software introduces certain risks that traders and developers should be aware of.

- Latency Issues: Rapid data influx may cause delays in trade execution, leading to missed opportunities.

- Data Integrity Concerns: Errors in transmission can mislead algorithms, resulting in inaccurate trading decisions.

- Vulnerability to Market Volatility: Over-reliance on real-time data can prompt excessive trading activity during market fluctuations.

- Technological Risks: System failures or technical glitches may disrupt data flow, impacting trading performance.

- Regulatory Compliance Challenges: Processing real-time data in line with market regulations can be complex and pose legal risks.

- Mitigation Strategies: Robust risk management and stress testing are crucial to address and minimise these risks effectively.

The significance of real-time data in algorithmic trading software cannot be overstated. Its instantaneous nature provides critical insights for making split-second decisions in the dynamic landscape of financial markets and empowers traders with up-to-the-moment information, crucial for identifying opportunities and managing risks effectively. However, while invaluable, integrating real-time data necessitates a comprehensive understanding of the associated risks and the implementation of robust risk management strategies to harness its potential for optimising trading outcomes. If you plan to use real-time data while algo trading, we at uTrade Algos are always there to help.