Defining Algorithmic Trading

Algorithmic trading, often referred to as algo trading, is a method of executing trades in financial markets using predefined rules and automated processes.

- Instead of relying on human decision-making, algorithmic trading employs computer algorithms to analyse market data, identify trading opportunities, and execute orders at high speeds and frequencies.

- This approach offers advantages such as speed, accuracy, efficiency, and the ability to backtest and optimise strategies.

- However, it also carries risks, including technical failures and regulatory scrutiny. Overall, algorithmic trading has become a prominent feature of modern financial markets, providing traders with sophisticated tools to navigate complex market dynamics and capitalise on trading opportunities.

Five Rules for Successful Algorithmic Trading in India

Thorough Research and Strategy Development

Before diving into algorithmic trading, on platforms like uTrade Algos, it's essential to conduct thorough research and develop a robust trading strategy. This includes analysing historical market data, identifying patterns, and testing various algorithms to determine their effectiveness. A well-researched strategy provides a solid foundation and increases the probability of success in the dynamic Indian markets.

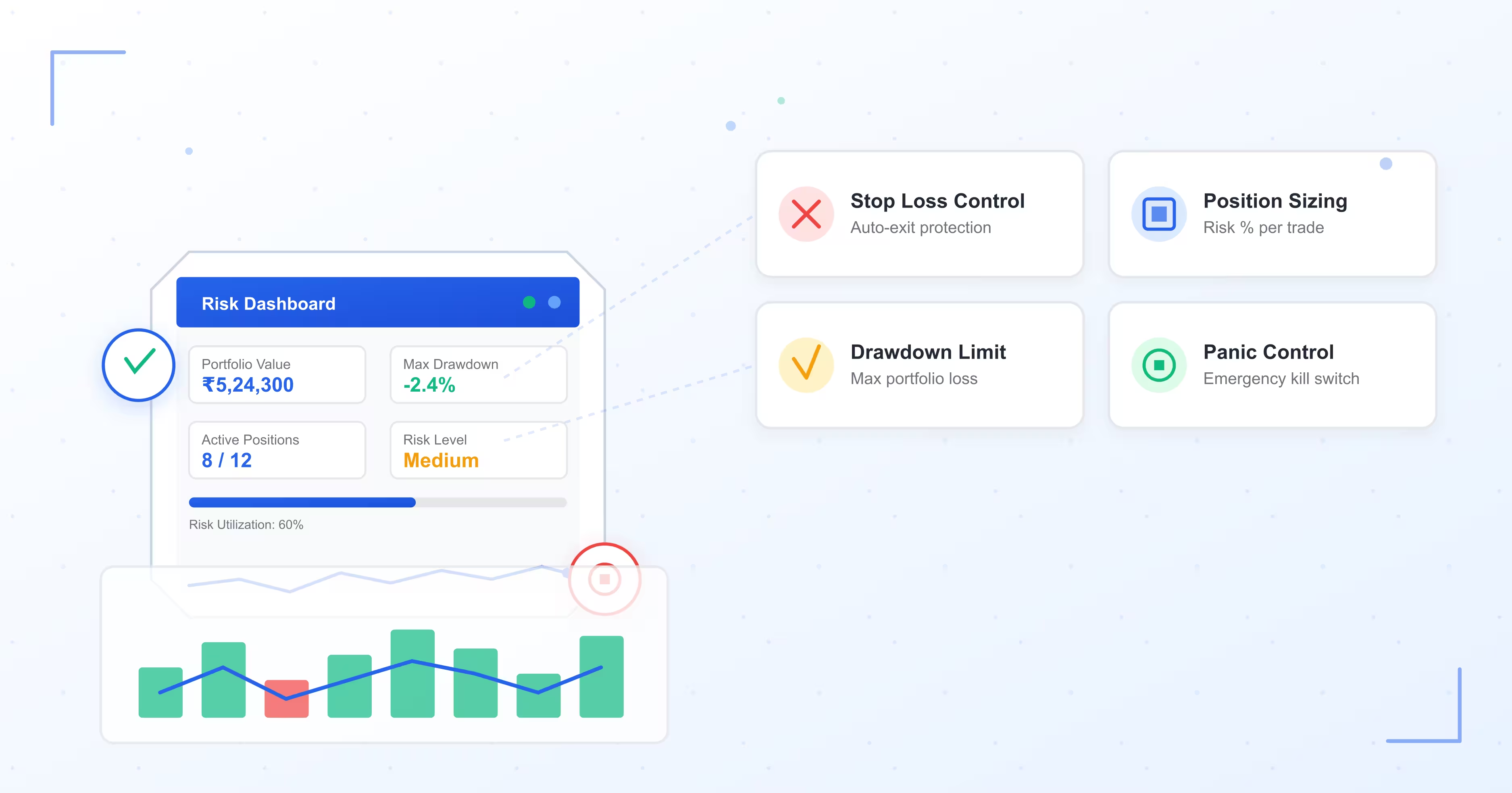

Risk Management

Effective risk management is paramount in algorithmic trading programs. Volatility and unpredictability are inherent in the Indian markets, making it crucial to establish risk parameters and adhere to them strictly. This involves setting stop-loss orders, defining position sizes, and implementing risk-reducing techniques such as diversification. By managing risk effectively, traders can protect their capital and mitigate potential losses.

Real Time Monitoring and Adaptation

Markets can change rapidly, influenced by economic indicators, geopolitical events, and other factors. Successful algorithmic traders continuously monitor market conditions and adapt their strategies accordingly. Utilising advanced analytics and machine learning algorithms can help identify emerging trends and adjust trading parameters in real time, maximising opportunities and minimising risks.

Leverage Technology

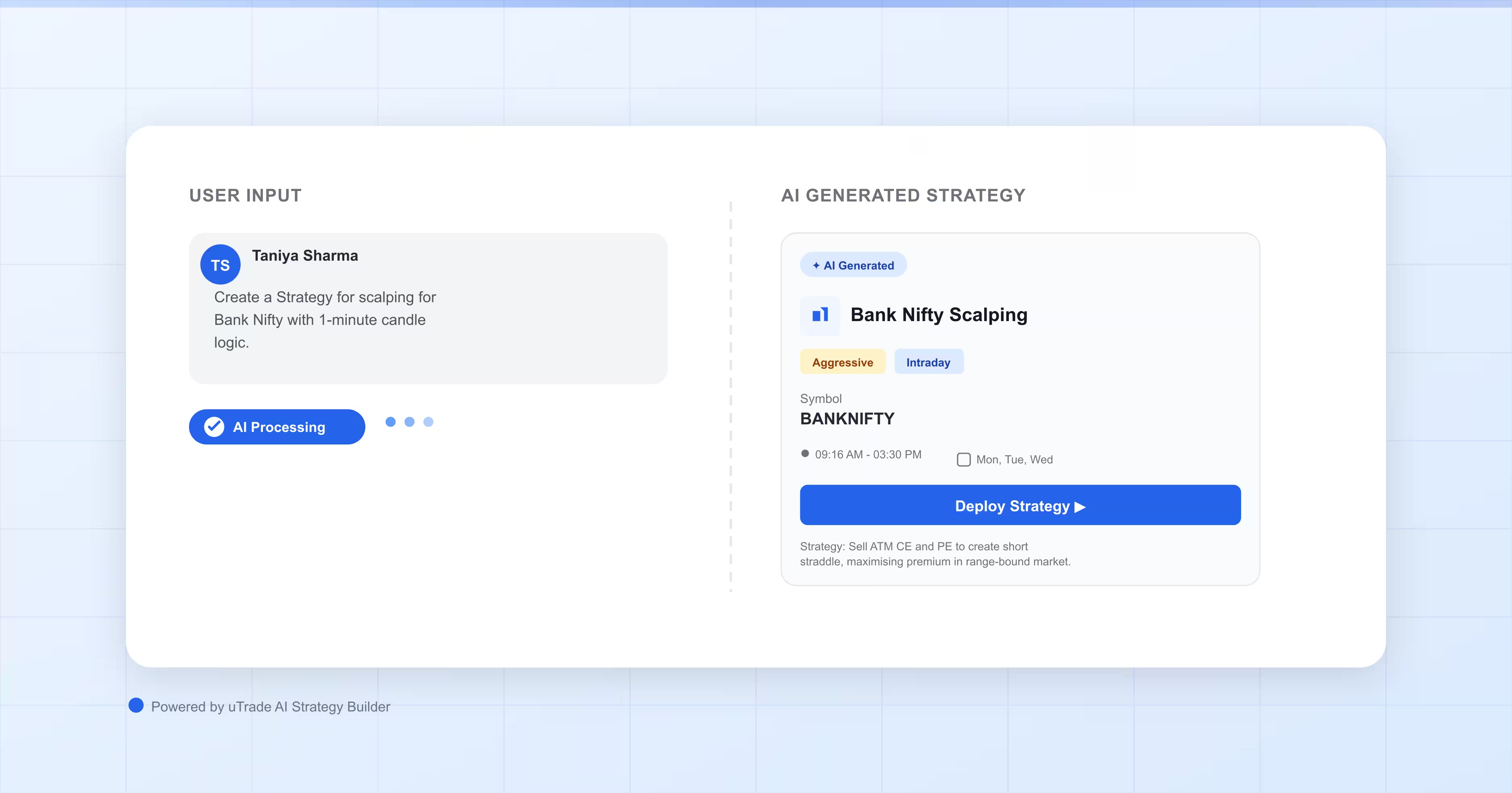

Algorithmic trading heavily relies on technology, and leveraging the right tools and infrastructure is crucial for success. This includes utilising high-speed internet connections, powerful hardware, and reliable trading platforms. Additionally, staying updated with the latest advancements in algorithmic trading software, such as artificial intelligence and algorithmic pattern recognition, can provide a competitive edge in the Indian markets.

Compliance and Regulation

As with any form of trading, algorithmic trading in India is subject to regulatory oversight. It's essential for traders to stay informed about relevant laws and regulations enforced by regulatory bodies such as the Securities and Exchange Board of India (SEBI). Adhering to compliance standards not only ensures legality but also fosters trust among investors and maintains market integrity.

Key Considerations for Choosing an Algo Trading Platform

When selecting a suitable algorithmic trading program in India, it's crucial to consider several factors to ensure it meets your trading needs effectively. Here are some tips to help you choose a good algo trading platform:

- Reliability and Stability: Opt for a platform that offers high reliability and stability, ensuring consistent uptime and minimal technical glitches.

- Execution Speed: Speed is critical in algorithmic trading, so choose a platform that provides fast order execution and low latency connectivity to the exchange.

- Market Access and Instrument Coverage: Ensure that the platform provides access to the markets and financial instruments you intend to trade. Look for platforms offering connectivity to major Indian exchanges like the National Stock Exchange (NSE) and the Bombay Stock Exchange (BSE), as well as a wide range of equities, derivatives, currencies, and commodities.

- Advanced Tools and Features: Evaluate the platform's features and tools for strategy development, backtesting, optimisation, and risk management. Like uTrade Algos, there are platforms that offer a user-friendly interface, customisable trading strategies, and robust analytics capabilities to support your trading objectives.

- Scalability and Flexibility: Choose a platform that can accommodate increasing trading volumes and support the scalability of your trading operations.

- Cost and Pricing Structure: Assess the platform's pricing structure, including any subscription fees, transaction costs, and additional charges.

- Regulatory Compliance: Ensure that the platform complies with regulatory requirements and standards set by regulatory bodies such as the Securities and Exchange Board of India (SEBI).

- Customer Support and Service: Choose a platform that offers prompt and reliable customer support, including technical assistance, training resources, and assistance with platform integration and setup.

Successful algorithmic trading in India, on platforms like uTrade Algos, requires a combination of technical expertise, market knowledge, and disciplined execution. By adhering to these top five rules – thorough research and strategy development, risk management, real time monitoring and adaptation, leveraging technology, and compliance with regulations – traders can navigate the complexities of the Indian markets and maximise their chances of success in algorithmic trading. However, it's essential to remember that algorithmic trading programs, like any form of investment, carry inherent risks, and traders should approach it with caution and diligence.