In the fast-paced and ever-evolving world of trading, where decisions are made in seconds, the importance of thorough preparation cannot be overstated. Backtesting trading stands as a critical tool in a trader's arsenal, offering a way to test and validate trading strategies using historical market data. This process provides invaluable insights into the potential performance and risks associated with a strategy before real capital is put on the line. Here, we explore the top seven reasons why a backtesting platform is crucial for trading success, focussing on its pivotal role in optimising strategies and mitigating risks.

1. Validation of Trading Strategies

The primary purpose of algo backtesting is to validate trading strategies against historical market data. By simulating trades based on specific rules and criteria, traders can assess how their strategies would have performed in past market conditions. This validation process helps in determining whether a strategy is robust and reliable enough to be deployed in live trading. It provides empirical evidence of the strategy's potential success and helps build confidence in its application.

2. Performance Evaluation

Algo trading backtesting allows traders to evaluate the performance of their strategies objectively. By analysing key metrics such as win rates, average returns per trade, maximum drawdowns, and risk-adjusted returns, traders gain insights into the strengths and weaknesses of their strategies. This evaluation helps in identifying which strategies are performing well and which may need further refinement or adjustment.

3. Identification of Market Opportunities

Backtesting helps traders identify and capitalise on market opportunities that may not be immediately apparent. By analysing historical data, traders can uncover patterns, trends, and anomalies that could present favourable outcomes. This proactive approach enables traders to develop strategies that are aligned with current market dynamics.

4. Optimisation of Parameters

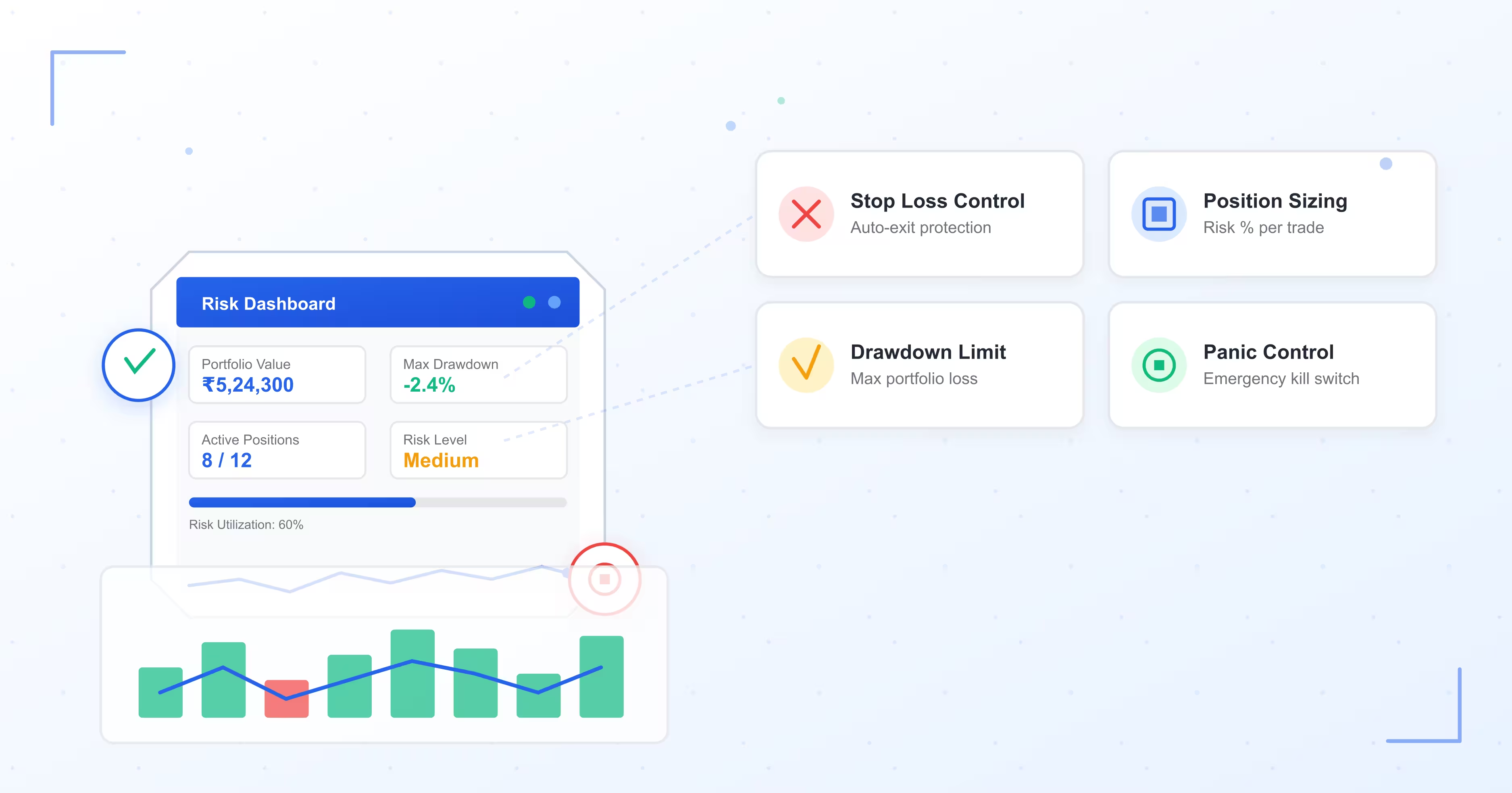

One of the significant advantages of backtesting algorithmic trading is its ability to optimise trading parameters. Traders can fine-tune variables such as entry and exit points, position sizing, and stop-loss levels based on historical data analysis. By experimenting with different parameter combinations and conducting iterative tests, traders can identify the optimal settings while controlling risks. This optimisation process ensures that strategies are adaptive and responsive to changing market conditions.

5. Confidence Building

Confidence is a crucial component of successful trading. Backtesting provides traders with empirical evidence of a strategy's performance over time, which builds confidence in its reliability and effectiveness. Seeing positive results from backtests reinforces traders' belief in their strategies and their ability to execute trades with discipline and conviction. This confidence is instrumental in adhering to trading plans during volatile market periods and avoiding emotional decision-making.

6. Strategy Refinement

Markets are dynamic and constantly evolving, requiring traders to adapt and refine their strategies continuously. Backtesting trading facilitates ongoing strategy refinement by identifying areas for improvement based on historical data analysis. Traders can analyse the impact of different market conditions, economic events, and geopolitical factors on their strategies' performance. By incorporating new insights and adjusting strategy parameters, traders can enhance the robustness and resilience of their trading approaches.

7. Educational Insights

Beyond immediate trading benefits, a backtesting platform provides valuable educational insights for traders. It enhances their understanding of market dynamics, price action patterns, and the interplay of various factors influencing trading outcomes. Traders can learn from both successful and unsuccessful backtests, gaining valuable experience that informs their decision-making processes and strategy development efforts.

Leveraging Backtesting on Algo Trading Platforms

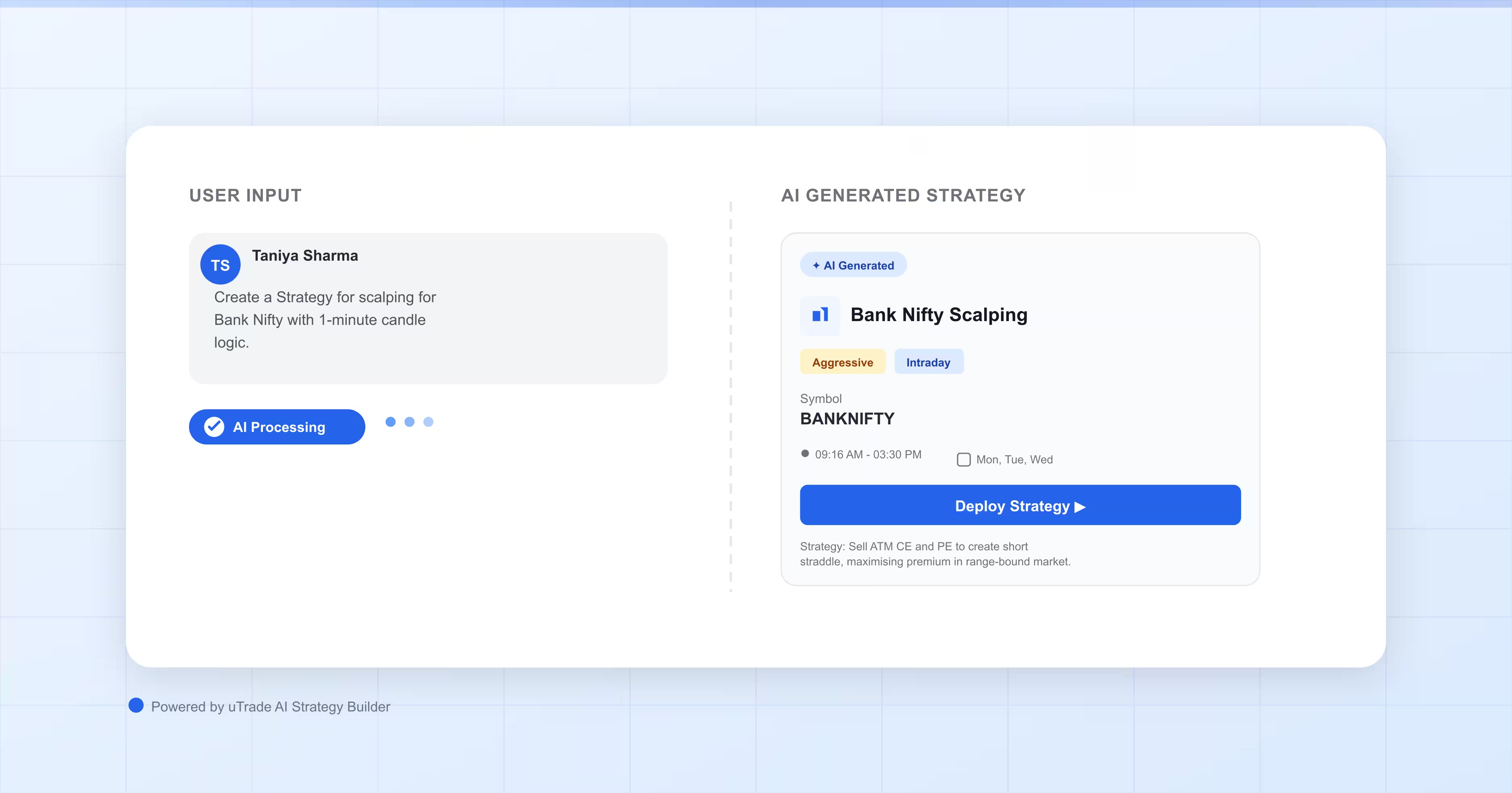

Algo trading platforms such as uTrade Algos offer sophisticated tools and functionalities that enhance the effectiveness of algo trading backtesting processes:

- Comprehensive Data Access: These platforms provide access to extensive historical market data across different asset classes and timeframes. Traders can conduct thorough backtests using reliable and high-quality data sources, ensuring accuracy and reliability in their analysis.

- Advanced Analytical Tools: Algo trading platforms offer advanced analytical tools and performance metrics that facilitate in-depth analysis of backtesting results. Traders can generate detailed reports, visualise trade outcomes, and assess strategy performance across various metrics.

- Customisable Testing Environments: Traders have the flexibility to customise backtesting algorithmic trading parameters and scenarios based on their specific trading strategies and objectives. They can adjust variables such as trading rules, risk parameters, and market conditions to simulate real-world trading environments accurately.

- Integration with Live Trading: Once a trading strategy has been thoroughly backtested and optimised, it can be seamlessly integrated into live trading environments. This integration ensures smooth execution and implementation of strategies in real-time market conditions.

In conclusion, algo backtesting is a cornerstone of successful trading strategies, offering traders a systematic approach to validate, evaluate, and optimise their trading approaches. By leveraging historical market data and advanced analytical tools available on backtesting platforms in India like uTrade Algos, traders can make informed decisions and enhance their overall trading performance. The importance of backtesting extends beyond mere validation; it fosters continuous learning and adaptation in response to evolving market dynamics. Traders who prioritise thorough backtesting are better equipped to navigate uncertainties and capitalise on opportunities.