Algorithmic trading, often known as algo trading, has changed the financial markets by using computer algorithms to execute trading decisions at speeds and frequencies that human traders cannot match. A critical component of this revolution is backtesting, a process that allows traders to test their algorithms on historical data before deploying them in live markets. This relationship between backtesting and algorithmic trading is fundamental to the reliability of trading strategies.

The Rise of Decentralised Finance (DeFi) in Automated Trading

In recent years, the financial landscape has witnessed a revolutionary shift with the rise of decentralised finance (DeFi), an innovative paradigm that challenges traditional financial systems. At the forefront of this transformative movement is the integration of DeFi into algo trading in India, a marriage that holds immense potential to reshape the future of finance. In this article, we find out more about the intricacies of DeFi and its intersection with automated trading.

Top 5 Key Metrics to Evaluate the Performance of Your Trading Algorithms

Unlocking the potential of algorithmic trading necessitates a keen eye on performance metrics. In this article, we delve into the essential top five metrics that serve as the compass for evaluating and enhancing the effectiveness of your trading algorithms. Understanding these metrics is crucial for optimising automated algorithmic trading strategies. Join us on this exploration into the world of algorithmic trading evaluation and learn how these metrics can guide you toward more informed and successful trading decisions.

Top 7 Common Mistakes to Avoid in Algo Trading: Lessons from Experts

Algorithmic trading, on some of the best algo trading platforms, has revolutionised how investors approach financial markets. Despite its advantages, pitfalls exist. This blog explores key mistakes and shares expert insights to help investors navigate the complexities of algo trading successfully.

Top 7 Technical Indicators for Algorithmic Traders

In algorithmic trading, on platforms like uTrade Algos, technical indicators play a crucial role in formulating trading strategies. These indicators provide valuable insights into market trends, momentum, and potential price movements, guiding algorithmic traders in their decision-making process. In this comprehensive guide, we'll explore the top seven technical indicators that algorithmic traders commonly rely on to identify profitable trading opportunities and optimise their automated algo trading strategies.

Understanding the Psychological Aspect: Why Emotions Matter in Intraday Trading

Intraday trading, be it via algorithmic trading or otherwise, with its rapid pace and constant market fluctuations, is not just a numbers game; it's an intricate dance of emotions. The psychological aspect of trading plays a pivotal role in decision-making and overall success. In this blog, we delve into the profound impact of emotions on intraday trading, understanding how emotional intelligence can be a trader's greatest asset.

What You Need to Know About Choosing the Right Automated Trading Software

In today's fast-paced financial markets, automated trading software has become a popular tool for traders looking to streamline their trading activities and capitalise on market opportunities. However, with a plethora of options available in the market, choosing the right algorithmic trading software can be a daunting task. In this blog, we'll discuss everything you need to know about selecting the best-automated trading software for your trading needs.

Why Algorithmic Trading Enhances Intraday Strategies

Intraday trading demands swift decision-making and precise execution to capitalise on short-term market movements. Algorithmic trading programs have emerged as a powerful tool to enhance intraday strategies, offering a range of benefits that traditional manual trading methods struggle to match. Here, we find why algorithmic trading is increasingly favoured by intraday traders and how it elevates their trading strategies.

Why Algorithmic Trading is Transforming the Financial Markets

In the dynamic landscape of finance, algorithmic trading stands as a revolutionary force reshaping the financial markets. This transformation is driven by the marriage of cutting-edge technology and sophisticated algorithms, bringing unprecedented speed, efficiency, and data-driven decision-making to the forefront. In this article, we explore the fundamental reasons behind the transformative impact of algorithmic trading, uncovering how it is redefining market dynamics and influencing the way financial transactions unfold.

Why Diversification Matters in Automated Trading Portfolios

In the fast-paced world of automated algo trading in India, where algorithms execute trades at lightning speed, diversification remains a cornerstone strategy for savvy investors. While the allure of high-frequency trading and rapid profit generation may be enticing, relying on a single trading strategy or asset class can expose investors to unnecessary risks. In this blog, we delve into why diversification matters in automated algorithmic trading portfolios and how it can enhance investment resilience and long-term success.

Claim your 7-day free trial!

- 2 Backtests per Day

- Access to uTrade Originals

- Create Upto 5 Algos

Frequently Asked Questions

Expand All

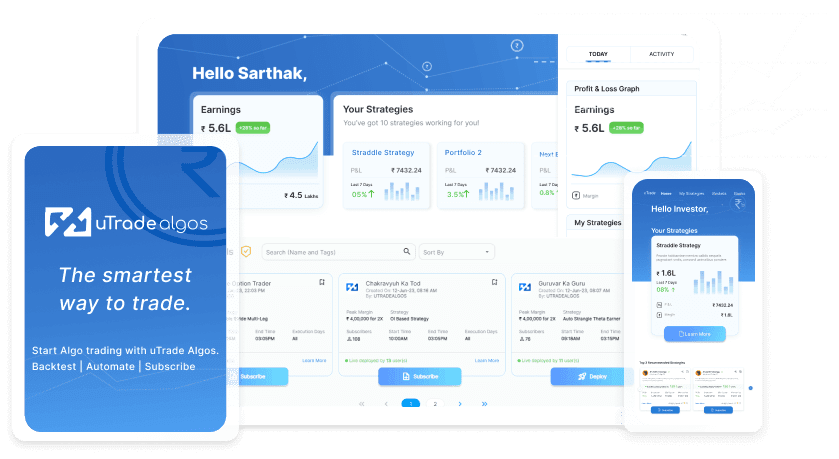

uTrade Algo’s proprietary features—advanced strategy form, one of the fastest algorithmic trading backtesting engines, and pre-made strategies—help you level up your derivatives trading experience

The dashboard is a summarised view of how well your portfolios are doing, with fields such as Total P&L, Margin Available, Actively Traded Underlyings, Portfolio Name, and Respective Underlyings, etc. Use it to quickly gauge your algo trading strategy performance.

You can sign up with uTrade Algos and start using our algo trading software instantly. Please make sure to connect your Share India trading account with us as it’s essential for you to be able to trade in the live markets. Watch our explainer series to get started with your account.

While algo trading has been in use for decades now for a variety of purposes, its presence has been mainly limited to big institutions. With uTrade Algos you get institutional grade features at a marginal cost so that everyone can experience the power of algos and trade like a pro.

On uTrade Algos, beginners can start by subscribing to pre-built algos by industry experts, called uTrade Originals. The more advanced traders can create their own algo-enabled portfolios, with our no-code and easy-to-use order form, equipped with tons of features such as robust risk management, pre-made algorithmic trading strategy templates, payoff graphs, options chain, and a lot more.

From single-leg strategies to complex portfolios, with upto five strategies, each strategy having up to six legs, uTrade Algos gives one enough freedom to create almost any auto trading strategy one likes. What’s more, is that there are pre-built algos by industry experts for complete beginners and pre-made strategy templates for those who want to try their hand at strategy creation.

An interesting feature that uTrade Algos is bringing to the table is a set of pre-built algorithms curated by top-ranking industry experts who have seen the financial markets inside out. These algorithms, called uTrade Originals, will be available for subscribers on the platform.

Algos have the capability to fire orders to the exchange in milliseconds, a speed which is impossible in manual trading. That is why traders leverage the power of algo trading to make their efforts more streamlined and efficient. You can try uTrade Algos for free for 7 days!