Importance of Integrated Margin Calculators for Algo Traders

Instant Margin Assessments

- When it comes to algo trading in India and elsewhere, Integrated margin calculators provide real time margin calculations, crucial for dynamic market conditions where margin obligations can change rapidly.

- Traders can access instant margin assessments, allowing them to make timely decisions and avoid margin deficits or liquidations.

- This feature offers invaluable support during market volatility, enabling traders to stay ahead of margin requirements and maintain their positions effectively.

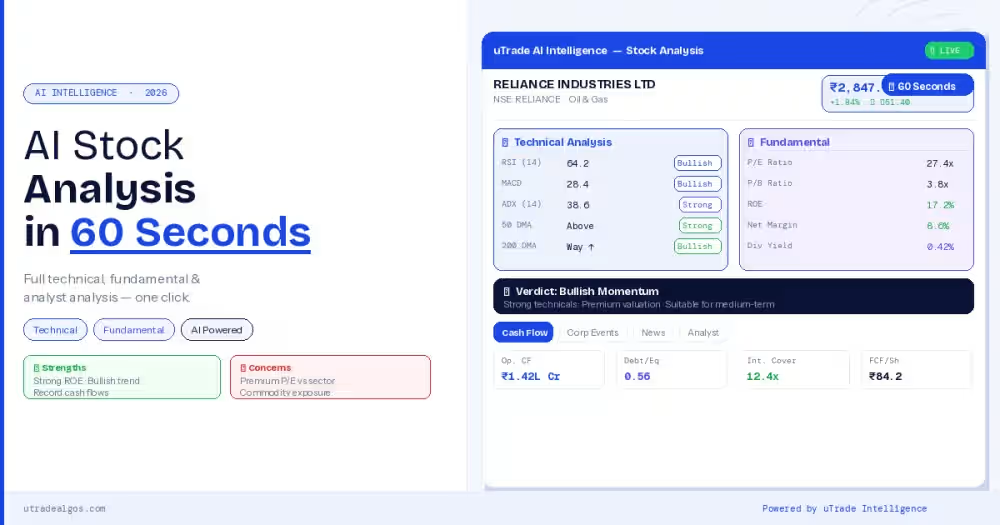

- Additionally, on the algorithmic trading software uTrade Algos, uTrade Originals offers pre-built algorithms by experts for optimised trading. It caters to novices and pros alike, focusing on diverse market conditions.

Accurate Risk Evaluation

- Algo traders rely on integrated margin calculators to accurately assess their risk exposure across various trading positions.

- These tools utilise advanced algorithms to evaluate risk factors such as volatility, correlation, and market conditions, providing precise risk evaluation.

- By understanding their risk exposure accurately, traders can adjust their positions strategically to minimise potential losses and optimise risk-adjusted returns.

Efficient Portfolio Management

- In algo trading, integrated margin calculators play a crucial role in efficient portfolio management for algo traders managing diverse portfolios.

- Traders can analyse the margin impact of proposed trades on their entire portfolio, enabling them to optimise capital allocation and maximise returns.

- This optimisation ensures that traders can effectively balance risk and reward across their portfolios, enhancing overall performance.

Compliance Assurance

- Compliance with margin regulations is essential for algo traders to avoid regulatory penalties and maintain market integrity.

- Integrated margin calculators ensure compliance by accurately calculating margin obligations based on prevailing regulatory requirements.

- These tools provide real time updates and adjustments to margin calculations, helping traders adhere to regulatory standards and mitigate compliance risks.

Tailored Customisation

- Integrated margin calculators offer customisable settings and parameters to meet the unique needs and preferences of individual traders.

- Traders can adjust margin requirements based on their specific trading strategies, risk tolerance, and market conditions.

- This customisation enhances flexibility and adaptability, allowing traders to optimise margin utilisation and maximise trading efficiency according to their unique preferences.

Also, novices often seek to dip their toes into trading without significant financial commitment. An algorithmic trading software like uTrade Algos caters to this need by offering a 14-day free trial. One can explore the uTrade Algos web and mobile app seamlessly, with no strings attached and access uTrade Originals and experiment with crafting up to five unique algorithms to enhance the trading journey.

Challenges and Limitations of Margin Calculation Technology

- Complexity: Margin calculation algorithms can be complex, requiring advanced mathematical models and computational resources.

- Data Accuracy: Dependence on accurate market data is crucial for precise margin calculations, but data inaccuracies or delays can impact the reliability of calculations.

- Regulatory Compliance: Keeping up with changing regulatory requirements and ensuring compliance poses challenges for margin calculation technology.

- Scalability: Margin calculation systems need to handle large volumes of trades and complex portfolios, requiring scalable infrastructure and efficient processing capabilities.

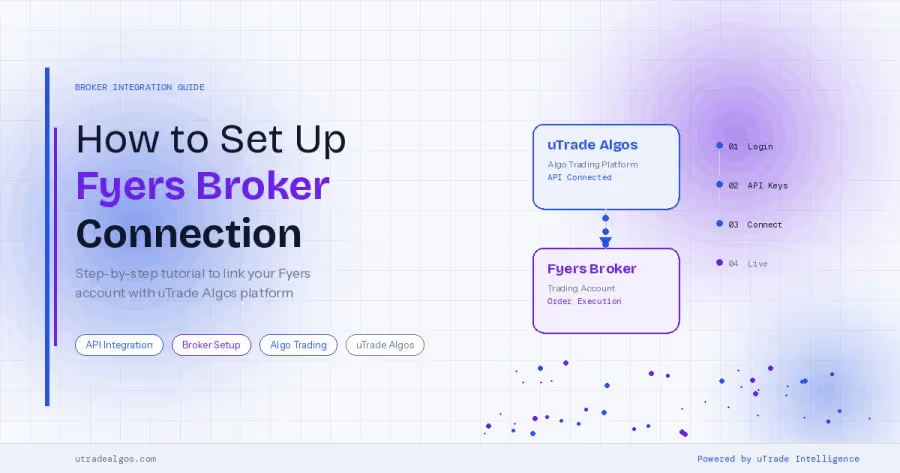

- Integration Issues: Integrating margin calculation systems with existing trading platforms or infrastructure can be challenging and may require customisation.

- Risk of Errors: Despite advanced algorithms, there's always a risk of calculation errors, which can lead to incorrect margin assessments and potential losses.

Future Trends and Innovations in Margin Calculation Technology

- AI and Machine Learning: Continued integration of AI and machine learning technologies to enhance margin calculation accuracy and efficiency.

- Predictive Analytics: Leveraging predictive analytics to anticipate market movements and adjust margin requirements proactively.

- Cloud Computing: Increased adoption of cloud-based margin calculation solutions for scalability, flexibility, and cost-effectiveness.

- Real Time Monitoring: Advancements in real time monitoring capabilities to provide instant updates on margin requirements and risk exposure.

- Regulatory Technology: Development of specialised regulatory technology solutions to automate compliance processes and ensure adherence to regulatory requirements.

- Algorithmic Risk Management: Integration of algorithmic risk management techniques to identify and mitigate potential margin-related risks in real time.

- Customisation and Personalisation: Enhanced customisation options to tailor margin calculation algorithms to the specific needs and preferences of individual traders.

- Blockchain Technology: Exploration of blockchain-based solutions for transparent, secure, and decentralised margin calculation processes.

These trends and innovations are expected to drive the evolution of margin calculation technology, enabling more efficient, accurate, and compliant margin management for algo traders in the future.In conclusion, one can say that integrated margin calculators, on algo trading platforms like uTrade Algos, are indispensable tools for algo traders, providing real time margin assessments, accurate risk evaluation, efficient portfolio management, compliance assurance, and tailored customisation options. When it comes to algo trading in India and across the world, with these powerful tools, traders can navigate market complexities effectively and achieve their trading goals with confidence and precision.