In recent years, algorithmic trading, or algo trading, has revolutionised the way financial markets operate. With the use of complex algorithms and advanced technology, traders can execute trades at lightning speeds, capturing opportunities in the market with precision and efficiency. However, as algo trading becomes more prevalent, ensuring the security of trading platforms has become paramount. In this blog, we will find out about the importance of security in algo trading and explore how traders can safeguard their investments by choosing the best platforms.

Understanding Algorithmic Trading

Algorithmic trading, also known as algo trading or automated trading, refers to the use of computer algorithms to execute trading strategies. These algorithms analyse market data, identify trading opportunities, and automatically execute trades based on predefined criteria. Algo trading has become increasingly popular among institutional investors and individual traders alike due to its ability to execute trades with speed and accuracy, minimising human error and emotion.

Importance of Security in Algo Trading

While algo trading offers numerous benefits, including increased efficiency and reduced trading costs, it also introduces new risks, particularly in terms of security.

- As algorithmic trading programs rely heavily on technology and connectivity, they are vulnerable to various security threats, including hacking, data breaches, and system failures.

- These risks can result in financial losses, reputational damage, and regulatory scrutiny, making security a top priority for traders and trading platforms alike.

Key Security Considerations for Algo Traders

- Platform Security: When algo trading, traders should prioritise platforms that offer robust security measures, such as encryption, firewalls, and multi-factor authentication. These security features help protect sensitive data and prevent unauthorised access to trading accounts.

- Data Protection: Algo trading platforms handle vast amounts of sensitive data, including trade orders, account information, and market data. It is essential for traders to ensure that their chosen platform employs strict data protection measures to safeguard this information from unauthorised access or disclosure.

- Regulatory Compliance: Regulatory compliance is another critical aspect of security in algo trading. Traders should ensure that their chosen platform complies with relevant regulations and industry standards. Compliance with these regulations helps mitigate legal and regulatory risks associated with algo trading.

- System Reliability: In algorithmic trading, platforms must be reliable and resilient to ensure uninterrupted trading operations. Traders should choose platforms that offer high availability, redundancy, and disaster recovery capabilities to minimise the risk of system failures or downtime.

- Vendor Due Diligence: Before selecting an algo trading platform, traders should conduct thorough due diligence on the platform vendor. This includes assessing the vendor's reputation, financial stability, track record, and security practices. Traders should also inquire about the platform's compliance certifications and security audits to ensure adherence to industry best practices.

Tips on Choosing an Algo Trading Platform

Choosing the right platform during algorithmic trading is crucial for success in the market. In this guide, we'll provide valuable tips on how to select the best algorithmic trading programs that meet your trading needs.

Define Your Trading Objectives

Before choosing an algorithmic trading program, it's essential to define your trading objectives and goals. Determine whether you're looking for short-term profits, long-term investments, or diversification strategies. Understanding your trading style and preferences will help you narrow down your options and choose a platform that aligns with your objectives.uTrade Algos is a platform that caters to both novices and experienced traders alike. Seasoned traders can leverage interactive payoff graphs for in-depth analysis, while beginners can rely on uTrade Originals, expert-crafted strategies, to kickstart their trading journey with confidence.

Assess Platform Reliability

Reliability is crucial when it comes to algo trading. Look for platforms that offer high availability, uptime guarantees, and robust infrastructure to ensure uninterrupted trading operations. Consider reading reviews and testimonials from other traders to gauge the platform's reliability and performance under different market conditions.

Research Platform Features

Take the time to research and compare the features offered by different algo trading platforms. Look for platforms that offer a wide range of functionalities, including backtesting tools, customisable trading strategies, real-time data feeds, and technical analysis indicators. Consider whether the platform supports your preferred trading instruments, such as stocks, forex, or cryptocurrencies. For instance, on uTrade Algos, traders can extensively utilise historical data for comprehensive strategy backtesting. This feature allows users to assess the effectiveness of their trading strategies based on past market performance, enabling them to refine and optimise their approaches for better results in the future.

Evaluate Security Measures

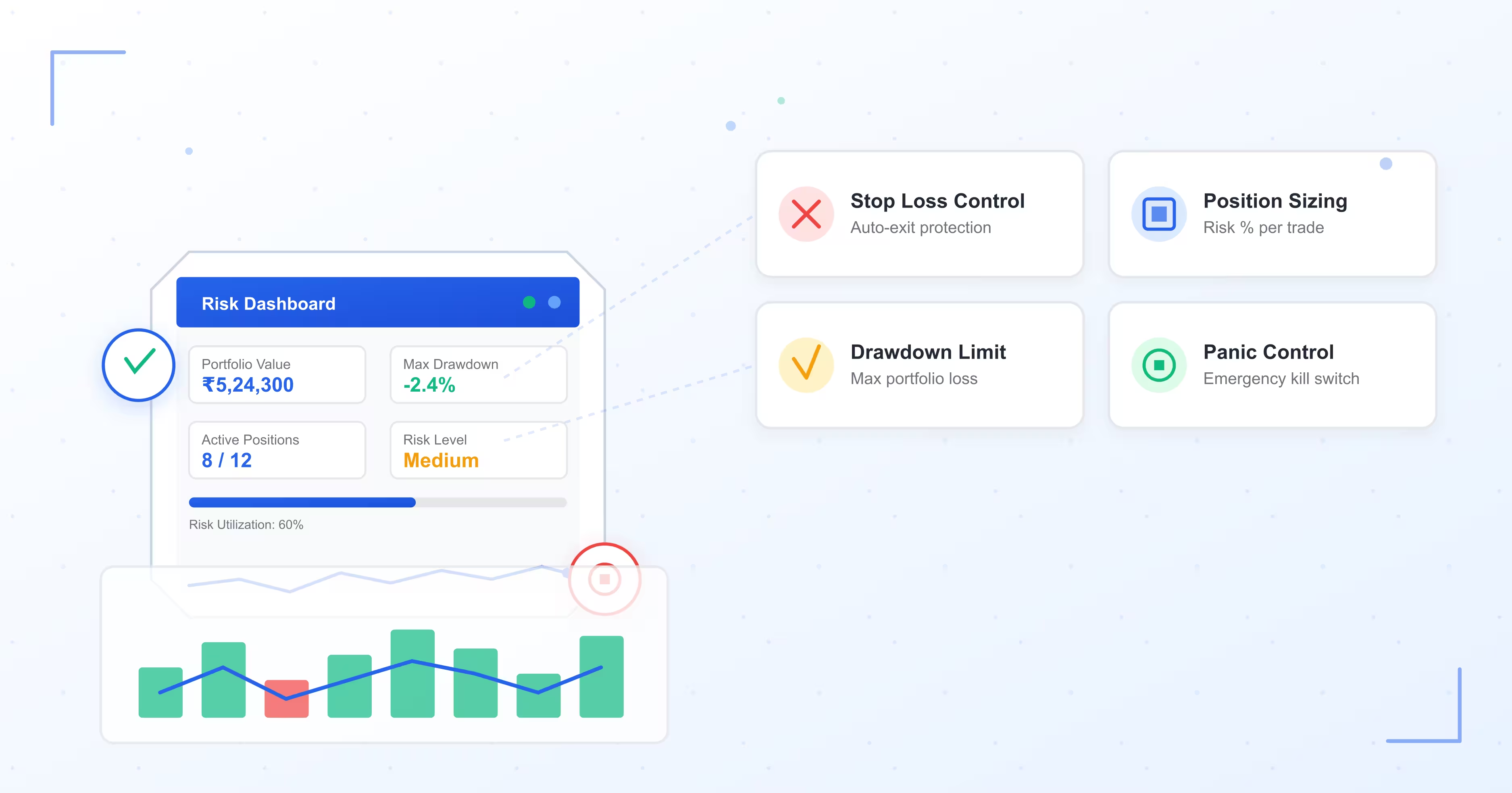

Security should be a top priority when choosing an algo trading platform. Ensure that the platform implements strong security measures, such as encryption, firewalls, and multi-factor authentication, to protect your trading account and sensitive data from cyber threats. Additionally, verify whether the platform is compliant with industry regulations and standards to safeguard your investments.

Consider Ease of Use

Choose an algorithmic trading programs that is user-friendly and intuitive to navigate, especially if you're new to algorithmic trading. Look for platforms with a clean and intuitive interface, comprehensive documentation, and responsive customer support to assist you with any technical issues or inquiries. A user-friendly platform will streamline your trading experience and help you focus on executing profitable strategies.

uTrade Algos stands out as a user-friendly platform, offering intuitive navigation and clear interfaces for traders of all levels. Novice traders can easily navigate through the platform's features, while experienced traders can leverage advanced tools and functionalities. Additionally, it provides robust customer support, enhancing the overall user experience and ensuring seamless interaction with the platform.

Review Pricing and Fees

Consider the pricing structure and fees associated with the algo trading platform before making a decision. Compare the pricing plans offered by different platforms and assess whether they align with your budget and trading volume. Be wary of platforms that charge excessive fees or hidden costs, as they can eat into your profits over time.

Test the Platform

Before committing to a particular algo trading platform, take advantage of any free trials or demo accounts offered by the platform. uTrade Algos, for instance, offers a 14-day free trial, allowing users to explore the platform's features and capabilities without any financial commitment. One should use such opportunities to test the platform's features, functionality, and performance in a simulated trading environment. Pay attention to factors such as execution speed, order management capabilities, and reliability during peak trading hours.

To conclude, security is of utmost importance in algo trading, as it ensures the safety and integrity of traders' investments. By choosing the best platforms with robust security measures, traders can mitigate the risks associated with algo trading and trade with confidence. Additionally, staying informed about the latest security threats and best practices is essential for maintaining a secure trading environment. With the right security measures in place, traders can maximise their opportunities in the dynamic world of algo trading while minimising potential risks.