In algorithmic trading, where quick decisions can make or break a strategy, robust data management is not just a necessity; it's a strategic imperative. Algorithmic trading, or algo trading, relies heavily on vast amounts of data to execute strategies with precision. Let us uncover why algo trading requires meticulous data management practices and highlight strategies for effective data management within the context of algo trading in India.

Learn the Difference Between Algo Trading vs Manual Trading

Picture this: You’re a trader who has been working hard to analyse trends and make trades. You spend hours in understanding various markets and analysing the movement of the stock prices before you finally decide which stock you should buy or sell. Suddenly, you find yourself surrounded by a computer program that executes trade swiftly by just following a pre-existing strategy of investment that is fed into. This is where the debate of algo trading vs. manual trading begins dominating the current scenes in the financial markets globally.

A Beginner’s Guide to Algorithmic Trading

Algorithmic Trading is the use of computer programs to make trade decisions automatically. It follows specific rules using mathematical models and market conditions, providing efficient and precise execution while minimizing human error and emotional biases.

Algorithmic trading has many advantages, including high-profit opportunities, increased liquidity, removal of emotional bias, efficient trade execution, and the ability to trade multiple markets and assets efficiently. Additionally, it can be backtested using historical and real-time data to determine if a trading strategy is viable.

The algorithms used in algo trading are generally tested logically or historically to determine their effectiveness. Logical testing involves following a set of rules and calculations to determine if a strategy will be profitable. Historical testing involves applying a rule or set of rules over past years to see if they would have made money.

10 Traits of a Successful Algo Trader

Successful traders possess certain traits that help them make the right decisions and maximize their profits. It is also important to have a solid understanding of the market and to continuously educate oneself about trading strategies and techniques. Algorithmic trading platforms can be useful in helping traders develop discipline and control. It is also important to be realistic in one's expectations and to have patience and persistence.

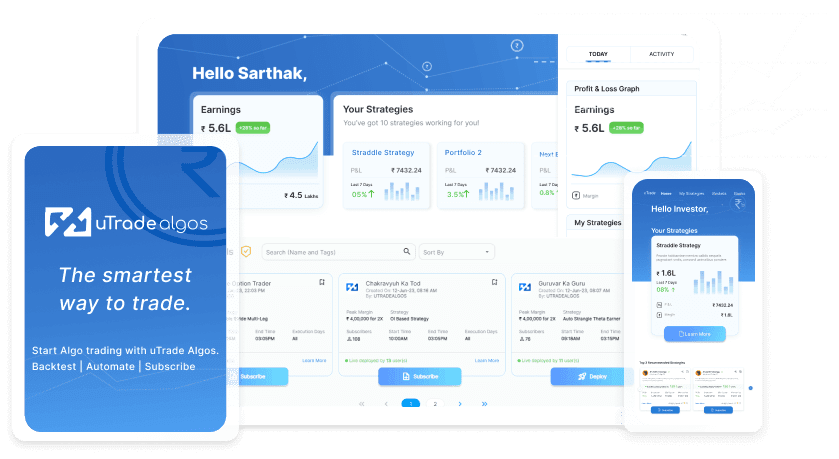

Press Release of uTrade Algos

Starting April 7, some users will receive beta access to uTrade Algos’ platform.

The different types of derivatives and options, their flexibility and usefulness for managing risk and pursuing profits in the financial markets. A simple example is provided to illustrate how options work.

What is Chart Patterns?

Dive deep into some of the most common but reliable chart patterns to better spot opportunities in the market!

How to Maximize Returns On Investment?

This comprehensive trading guide would take you to an intermediate level when it comes to Trading. Not only will you understand the working of various Technical Indicators but it will also enable you to use several indicators in combination, thus being more certain when the trading system generates a signal and to be able to bet your money with more conviction!

Claim your 7-day free trial!

- 2 Backtests per Day

- Access to uTrade Originals

- Create Upto 5 Algos

Frequently Asked Questions

Expand All

uTrade Algo’s proprietary features—advanced strategy form, one of the fastest algorithmic trading backtesting engines, and pre-made strategies—help you level up your derivatives trading experience

The dashboard is a summarised view of how well your portfolios are doing, with fields such as Total P&L, Margin Available, Actively Traded Underlyings, Portfolio Name, and Respective Underlyings, etc. Use it to quickly gauge your algo trading strategy performance.

You can sign up with uTrade Algos and start using our algo trading software instantly. Please make sure to connect your Share India trading account with us as it’s essential for you to be able to trade in the live markets. Watch our explainer series to get started with your account.

While algo trading has been in use for decades now for a variety of purposes, its presence has been mainly limited to big institutions. With uTrade Algos you get institutional grade features at a marginal cost so that everyone can experience the power of algos and trade like a pro.

On uTrade Algos, beginners can start by subscribing to pre-built algos by industry experts, called uTrade Originals. The more advanced traders can create their own algo-enabled portfolios, with our no-code and easy-to-use order form, equipped with tons of features such as robust risk management, pre-made algorithmic trading strategy templates, payoff graphs, options chain, and a lot more.

From single-leg strategies to complex portfolios, with upto five strategies, each strategy having up to six legs, uTrade Algos gives one enough freedom to create almost any auto trading strategy one likes. What’s more, is that there are pre-built algos by industry experts for complete beginners and pre-made strategy templates for those who want to try their hand at strategy creation.

An interesting feature that uTrade Algos is bringing to the table is a set of pre-built algorithms curated by top-ranking industry experts who have seen the financial markets inside out. These algorithms, called uTrade Originals, will be available for subscribers on the platform.

Algos have the capability to fire orders to the exchange in milliseconds, a speed which is impossible in manual trading. That is why traders leverage the power of algo trading to make their efforts more streamlined and efficient. You can try uTrade Algos for free for 7 days!