Algorithmic trading has become increasingly popular among traders looking to automate their strategies and capitalise on market opportunities. With the rise of algorithmic trading platforms like the uTrade Algos algo trading app, traders have access to powerful tools and technologies to execute trades with precision and efficiency. However, to make the most of these tools, it's essential to optimise your algorithmic trades effectively. Let us explore seven essential tips for optimising your algorithmic trades using the app.

Algorithmic trading, or algo trading, leverages computer programs to execute trades at high speeds and frequencies. The success of an algorithm is often predicated on a backtesting platform, which involves running the algorithm on historical market data to assess its performance. However, the realism of these market conditions in backtesting is crucial for several reasons. Ensuring realistic market conditions can significantly influence the accuracy and reliability of the algo backtest results, thereby affecting the eventual success of the trading strategy in real-world scenarios.

Algorithmic trading has changed financial markets by enabling traders to execute complex strategies at lightning speed. However, the success of these strategies hinges on robust algo backtesting—a process that involves simulating trading strategies on historical data to evaluate their performance. For traders and developers, understanding and tracking key metrics during algo backtest is essential to refine and optimise these strategies. This blog delves into the crucial metrics that should be monitored in algo trading backtesting, on a backtesting platform like uTrade Algos, to ensure robust and reliable trading systems.

What Role Does AI Play in Algorithmic Trading?

In the ever-evolving landscape of algorithmic trading in India, AI has emerged as a game-changer, changing the way trading strategies are developed, executed, and optimised. At uTrade Algos, we recognise its significance and are eager to share the multifaceted role of AI in algorithmic trading platforms within the dynamic realm of financial markets.

In the fast-paced world of algorithmic trading, on various algo trading platforms, market making plays a pivotal role in ensuring liquidity, facilitating efficient price discovery, and maintaining orderly markets. This blog delves into the fundamentals of market making, exploring its principles, strategies, and execution in algorithmic trading.

How to Optimise Execution Algorithms for Low Latency Trading

In today's ‘fast’ financial markets, every second counts. For traders seeking to gain an edge in this high-speed environment, optimising execution algorithms on algo trading platforms for low latency trading is paramount. In this guide, we'll delve into the intricacies of low-latency trading and explore strategies to optimise execution algorithms for maximum efficiency. It is our endeavour at uTrade Algos to assist you in understanding these complexities and empower you with the tools and knowledge needed to thrive in the fast-paced world of algo trading in India and across the globe.

Why Algorithmic Trading Requires Robust Data Management

In algorithmic trading, where quick decisions can make or break a strategy, robust data management is not just a necessity; it's a strategic imperative. Algorithmic trading, or algo trading, relies heavily on vast amounts of data to execute strategies with precision. Let us uncover why algo trading requires meticulous data management practices and highlight strategies for effective data management within the context of algo trading in India.

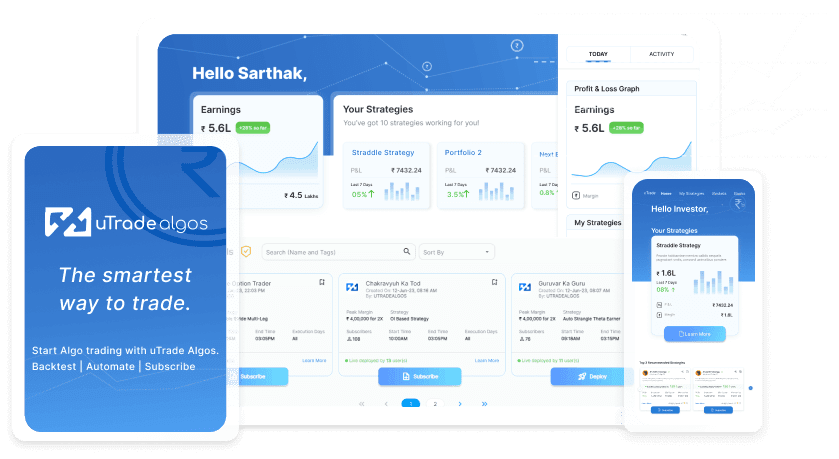

In today's rapidly evolving financial landscape, algorithmic trading has emerged as a powerful tool for traders seeking to capitalise on market opportunities with speed and efficiency. Among the plethora of algorithmic trading platforms available in India, uTrade Algos stands out for its affordability, accessibility, and user-friendly interface. Read on to learn about its myriad features and benefits.

Is Algorithmic Trading Surpassing Traditional Methods, Putting Traditional Traders at a Disadvantage?

In recent years, the landscape of financial markets has undergone a significant transformation with the rise of algorithmic trading on algo trading platforms in India like uTrade Algos. Traditional methods of trading, once dominant, are now being challenged by algo trading in India comprising sophisticated algorithms and high-frequency trading strategies. This shift begs the question: Is algorithmic trading on algo trading platforms surpassing traditional methods, putting traditional traders at a disadvantage?

In the world of options trading, where strategic decision-making is paramount, option payoff charts, on algo trading platforms, like uTrade Algos, serve as invaluable tools for traders. This blog delves into the intricacies of option payoff graphs, exploring how they enhance trading strategy development, optimise risk management, and empower traders to make informed decisions in dynamic financial markets.

Claim your 7-day free trial!

- 2 Backtests per Day

- Access to uTrade Originals

- Create Upto 5 Algos

Frequently Asked Questions

Expand All

uTrade Algo’s proprietary features—advanced strategy form, one of the fastest algorithmic trading backtesting engines, and pre-made strategies—help you level up your derivatives trading experience

The dashboard is a summarised view of how well your portfolios are doing, with fields such as Total P&L, Margin Available, Actively Traded Underlyings, Portfolio Name, and Respective Underlyings, etc. Use it to quickly gauge your algo trading strategy performance.

You can sign up with uTrade Algos and start using our algo trading software instantly. Please make sure to connect your Share India trading account with us as it’s essential for you to be able to trade in the live markets. Watch our explainer series to get started with your account.

While algo trading has been in use for decades now for a variety of purposes, its presence has been mainly limited to big institutions. With uTrade Algos you get institutional grade features at a marginal cost so that everyone can experience the power of algos and trade like a pro.

On uTrade Algos, beginners can start by subscribing to pre-built algos by industry experts, called uTrade Originals. The more advanced traders can create their own algo-enabled portfolios, with our no-code and easy-to-use order form, equipped with tons of features such as robust risk management, pre-made algorithmic trading strategy templates, payoff graphs, options chain, and a lot more.

From single-leg strategies to complex portfolios, with upto five strategies, each strategy having up to six legs, uTrade Algos gives one enough freedom to create almost any auto trading strategy one likes. What’s more, is that there are pre-built algos by industry experts for complete beginners and pre-made strategy templates for those who want to try their hand at strategy creation.

An interesting feature that uTrade Algos is bringing to the table is a set of pre-built algorithms curated by top-ranking industry experts who have seen the financial markets inside out. These algorithms, called uTrade Originals, will be available for subscribers on the platform.

Algos have the capability to fire orders to the exchange in milliseconds, a speed which is impossible in manual trading. That is why traders leverage the power of algo trading to make their efforts more streamlined and efficient. You can try uTrade Algos for free for 7 days!