In algorithmic trading, where seconds can make a difference, having effective exit parameters is crucial for managing risk and improving the chances of returns. Global exit parameters serve as predefined rules or conditions that trigger the exit of a trade, ensuring disciplined and systematic trading. In this guide, we'll find out about the concept of global exit parameters, explore their significance in algo trading, and understand how they function in real-world trading scenarios.

In the rapidly evolving world of financial markets, real-time data feeds have emerged as a critical component driving the success of algorithmic trading strategies. These data feeds provide traders with important information on market prices, order book dynamics, news events, and other pertinent factors influencing trading decisions. Let us delve into the significance of real-time data feeds in shaping algo trading in India.

In recent years, algo trading has changed the landscape of financial markets globally, including commodity markets. The adoption of algorithmic trading in India in commodities has been on the rise, presenting both opportunities and risks for market participants. At uTrade Algos, we recognise the increasing significance of commodity markets in India and the surging popularity of algo trading within this sector. Hence, our aim is to elucidate the importance of algo trading in India's commodity markets.

In the fast-paced world of algorithmic trading, where a few seconds can make or break a trade, ethical considerations play a crucial role in ensuring market integrity and investor confidence. As algo trading continues to gain prominence in India's financial landscape, traders must navigate a complex web of ethical challenges while harnessing the potential of automated trading strategies. Let us explore the nuanced ethical considerations and provide guidelines for traders operating on various algo trading platforms in India

Why RSI Indicator is Essential for Algorithmic Traders and How to Use for Effective Algo Trading

Algorithmic trading, on platforms like uTrade Algos, has enabled traders to execute complex strategies with speed, accuracy, and efficiency. Among the plethora of tools and indicators available to algorithmic traders, the Relative Strength Index (RSI) stands out as one of the most essential and versatile indicators. In this blog, we will delve into the importance of the RSI indicator for algorithmic trading programs and provide a comprehensive guide on how to effectively use it for successful algo trading.

What Makes RSI Indicator a Must-Have Tool for Algo Trading Platforms

The Relative Strength Index (RSI) is a popular momentum oscillator that has gained widespread recognition among traders and investors alike. It is a versatile technical indicator that measures the speed and change of price movements, helping traders identify overbought or oversold conditions in the market. In the realm of algorithmic trading, on platforms like uTrade Algos, the RSI indicator has emerged as a must-have tool for several compelling reasons. In this blog post, we will explore the key features and benefits of integrating the RSI indicator into algorithmic trading programs.

Understanding SPAN Margin: A Comprehensive Guide

In the dynamic world of derivatives trading, margin requirements play a crucial role in determining the capital needed to initiate and maintain positions. One of the most widely used margin systems globally is the Standard Portfolio Analysis of Risk (SPAN) margin. This blog aims to provide a comprehensive understanding of SPAN margin, its calculation methodology, significance, and implications for traders and investors.

SEBI Lot Size Changes; Here’s How It Will Impact uTrade Originals

In the world of algo trading, everything is dynamic. Traders need to be on their toes when it comes to trading algos. Be it fluctuations in the indices or changes in regulations laid down for trading, each has a significant impact on algo traders and their portfolios. And, a recent change in regulation by SEBI has left traders scratching their heads. But, we’re here to help you decode the same.

Algorithmic trading programs, like uTrade Algos, have, in recent times, become very popular in the financial markets by enabling traders to execute complex strategies with speed, precision, and automation. However, like any other trading approach, algorithmic trading is not without its risks. In this blog, we will explore the top five risks encountered in algorithmic trading software and provide insights and solutions to help traders navigate these challenges effectively.

SPAN Margin vs. Traditional Margin: A Comparative Analysis

Margin trading is a popular strategy employed by traders to amplify potential returns by borrowing funds to increase trading power. While margin trading offers the opportunity for higher profits, it also comes with increased risks. In algorithmic trading, understanding the different types of margin systems, such as SPAN margin and traditional margin, is essential for traders to effectively manage risk and optimise trading strategies. In this blog post, we will delve into a comparative analysis of SPAN Margin and Traditional Margin to help traders make informed decisions.

Claim your 7-day free trial!

- 2 Backtests per Day

- Access to uTrade Originals

- Create Upto 5 Algos

Frequently Asked Questions

Expand All

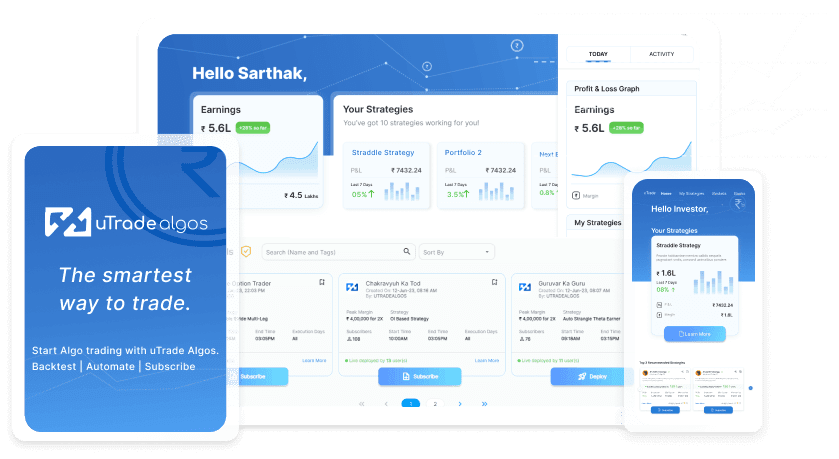

uTrade Algo’s proprietary features—advanced strategy form, one of the fastest algorithmic trading backtesting engines, and pre-made strategies—help you level up your derivatives trading experience

The dashboard is a summarised view of how well your portfolios are doing, with fields such as Total P&L, Margin Available, Actively Traded Underlyings, Portfolio Name, and Respective Underlyings, etc. Use it to quickly gauge your algo trading strategy performance.

You can sign up with uTrade Algos and start using our algo trading software instantly. Please make sure to connect your Share India trading account with us as it’s essential for you to be able to trade in the live markets. Watch our explainer series to get started with your account.

While algo trading has been in use for decades now for a variety of purposes, its presence has been mainly limited to big institutions. With uTrade Algos you get institutional grade features at a marginal cost so that everyone can experience the power of algos and trade like a pro.

On uTrade Algos, beginners can start by subscribing to pre-built algos by industry experts, called uTrade Originals. The more advanced traders can create their own algo-enabled portfolios, with our no-code and easy-to-use order form, equipped with tons of features such as robust risk management, pre-made algorithmic trading strategy templates, payoff graphs, options chain, and a lot more.

From single-leg strategies to complex portfolios, with upto five strategies, each strategy having up to six legs, uTrade Algos gives one enough freedom to create almost any auto trading strategy one likes. What’s more, is that there are pre-built algos by industry experts for complete beginners and pre-made strategy templates for those who want to try their hand at strategy creation.

An interesting feature that uTrade Algos is bringing to the table is a set of pre-built algorithms curated by top-ranking industry experts who have seen the financial markets inside out. These algorithms, called uTrade Originals, will be available for subscribers on the platform.

Algos have the capability to fire orders to the exchange in milliseconds, a speed which is impossible in manual trading. That is why traders leverage the power of algo trading to make their efforts more streamlined and efficient. You can try uTrade Algos for free for 7 days!