In recent years, Indian traders have been increasingly turning to algo backtesting platforms to enhance their trading strategies and decision-making processes. This surge in adoption can be attributed to several key factors, reflecting the evolving landscape of the Indian financial markets and the growing sophistication of traders seeking a competitive edge. In this blog, we explore the reasons behind this trend.

What Makes Algorithmic Trading Different in the Indian Context?

Algorithmic trading has rapidly gained popularity in global financial markets, but its dynamics in the Indian context present unique characteristics and challenges. In this blog, we delve into what sets algorithmic trading apart in the Indian market landscape and explore the factors shaping its growth and evolution.

Why Payoff Curves Matter in Algorithmic Trading

In algorithmic trading, where every decision can impact profitability, understanding the concept of option payoff charts is paramount. Payoff curves offer traders invaluable insights into potential trading outcomes, guiding decision-making and risk management strategies. Let's delve into why payoff curves matter and how they influence algorithmic trading in India and elsewhere.

Why Transparency Matters in Algorithmic Trading

In the world of finance, transparency is paramount for ensuring market integrity, fostering trust among participants, and maintaining investor confidence. When it comes to algorithmic trading programs, transparency plays a crucial role in promoting fairness, accountability, and ethical conduct. In this blog, we'll find out why transparency matters in algorithmic trading, on platforms like uTrade Algos, and the implications it has for traders, investors, and regulatory authorities.

Why Integrated Margin Calculators Are Crucial for Algo Traders

In the fast-paced world of algo trading, every second counts. Algo traders are constantly seeking ways to optimise their strategies and streamline their processes to gain a competitive edge in the market. One tool that has emerged as indispensable for algo traders is the integrated margin calculator. Let's delve into why these calculators are crucial for the success of algo traders.

Advantages and Benefits of Algo Trading Platform in India

In the ever-evolving landscape of financial markets, technology has become the cornerstone of efficiency and increased chances of profitability. One of the most revolutionary advancements in recent years is the advent of algo trading platforms. These platforms, powered by complex algorithms and high-speed computing, have transformed the way trading is conducted, offering a plethora of advantages and benefits to investors in India.

Top 5 Rules for Successful Algorithmic Trading in India

In recent years, algorithmic trading has gained significant traction in the Indian financial markets. This computerised trading method uses predefined instructions to execute trades at speeds and frequencies beyond human capabilities. However, navigating the complexities of algorithmic trading software requires more than just technical know-how; it demands a deep understanding of the market dynamics and adherence to specific rules. Here are the top five rules for successful algorithmic trading in India.

The Psychology Behind Payoff Curves: Understanding Trader Behaviour

Payoff curves are essential tools in trading, depicting the potential profit or loss of a trading strategy across various price levels. However, beyond their mathematical significance, payoff curves also reveal intriguing insights into trader behaviour and psychology. Understanding the psychological aspects behind payoff curves can provide valuable insights into how traders make decisions and manage risk. In this blog, we delve into the psychology behind payoff curves and explore their implications for trader behaviour.

Integrated Margin Calculators: The Future of Algo Trading

In recent years, the world of algorithmic trading has undergone significant advancements, revolutionising the way financial markets operate. One such innovation that has gained traction among traders is the integration of margin calculators into algo trading platforms like uTrade Algos. These sophisticated tools not only streamline the trading process but also offer a glimpse into the future of automated trading strategies.

How an Integrated Margin Calculator Boosts Trading Efficiency

In the dynamic world of trading, efficiency is paramount. Every second counts, and making informed decisions swiftly can make all the difference between success and missed opportunities. With the rise of algorithmic trading, traders are constantly seeking tools to streamline their processes and optimise their strategies. One such tool that has emerged as a game-changer is the integrated margin calculator.

Claim your 7-day free trial!

- 2 Backtests per Day

- Access to uTrade Originals

- Create Upto 5 Algos

Frequently Asked Questions

Expand All

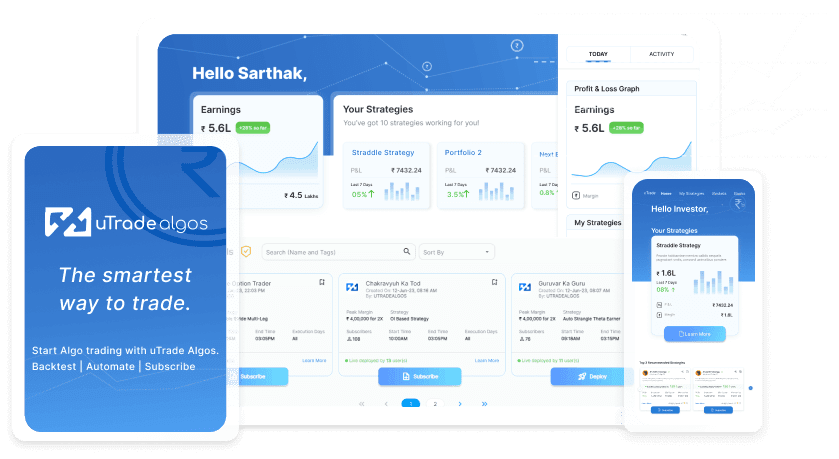

uTrade Algo’s proprietary features—advanced strategy form, one of the fastest algorithmic trading backtesting engines, and pre-made strategies—help you level up your derivatives trading experience

The dashboard is a summarised view of how well your portfolios are doing, with fields such as Total P&L, Margin Available, Actively Traded Underlyings, Portfolio Name, and Respective Underlyings, etc. Use it to quickly gauge your algo trading strategy performance.

You can sign up with uTrade Algos and start using our algo trading software instantly. Please make sure to connect your Share India trading account with us as it’s essential for you to be able to trade in the live markets. Watch our explainer series to get started with your account.

While algo trading has been in use for decades now for a variety of purposes, its presence has been mainly limited to big institutions. With uTrade Algos you get institutional grade features at a marginal cost so that everyone can experience the power of algos and trade like a pro.

On uTrade Algos, beginners can start by subscribing to pre-built algos by industry experts, called uTrade Originals. The more advanced traders can create their own algo-enabled portfolios, with our no-code and easy-to-use order form, equipped with tons of features such as robust risk management, pre-made algorithmic trading strategy templates, payoff graphs, options chain, and a lot more.

From single-leg strategies to complex portfolios, with upto five strategies, each strategy having up to six legs, uTrade Algos gives one enough freedom to create almost any auto trading strategy one likes. What’s more, is that there are pre-built algos by industry experts for complete beginners and pre-made strategy templates for those who want to try their hand at strategy creation.

An interesting feature that uTrade Algos is bringing to the table is a set of pre-built algorithms curated by top-ranking industry experts who have seen the financial markets inside out. These algorithms, called uTrade Originals, will be available for subscribers on the platform.

Algos have the capability to fire orders to the exchange in milliseconds, a speed which is impossible in manual trading. That is why traders leverage the power of algo trading to make their efforts more streamlined and efficient. You can try uTrade Algos for free for 7 days!