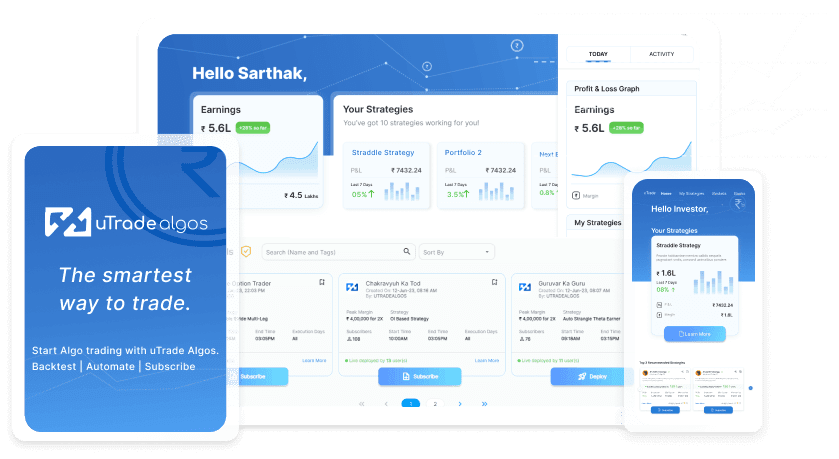

Crafting the perfect strategy in options trading requires a delicate balance between risk assessment, predictive analysis, and informed decision-making. Amidst the many tools available, option payoff charts stand out as indispensable instruments guiding traders through the complexities of quantitative analysis and algorithmic models, on various trading platforms like uTrade Algos. These charts serve as visual representations of potential profit or loss scenarios at various price levels of the underlying asset, offering traders a clearer perspective on the risk and reward dynamics associated with their positions. Let us understand more.

What are Payoff Charts?

Payoff charts, also known as profit and loss diagrams, are graphical representations used in finance, particularly in options trading, to illustrate the potential profit or loss of an investment or trading strategy at different prices of the underlying asset at expiration.

- These charts provide a visual depiction of the relationship between the price of the underlying security, the value of the option or investment, and the time remaining until expiration.

- They help traders and investors understand the potential outcomes of their positions, offering insights into the risk and reward dynamics associated with their investments or strategies.

- Payoff charts assist in analysing the profitability of various scenarios, aiding in decision-making processes related to investments and trading strategies.

Why is Visual Interpretation of Data Better?

Visual interpretation presents complex information in a clear, concise, and easily understandable format.

- They allow for quicker comprehension of trends, patterns, and relationships within the data compared to textual or numerical formats, making information more accessible to a broader audience.

- It enables humans to recognise patterns and outliers more effectively. They highlight trends, correlations, and anomalies within data sets, aiding in the identification of insights that might be less apparent when examining raw numbers or text.

- It has a more substantial impact on memory retention compared to textual information.

- It is inherently engaging and can captivate audiences, keeping them focused and interested in the presented information. This engagement often leads to better understanding and retention of the material being conveyed.

Understanding the Role of Option Payoff Charts

Visualisation of Outcomes

Payoff charts in algorithmic trading, on platforms like uTrade Algos, which is a no-code trading platform, offer a visual representation of potential outcomes based on different scenarios. By plotting various positions and their associated profits or losses, individuals can quickly grasp the impact of different market movements on their investments.

Risk Assessment

They assist in evaluating and quantifying risk. By illustrating the potential losses or gains at different price levels or time horizons, payoff graphs aid in risk assessment, helping investors make informed decisions and manage their risk exposure effectively.

Strategy Evaluation

Payoff charts enable the comparison of multiple investment strategies. Investors can overlay different strategies on a single chart, allowing for a comparative analysis of risk-return profiles. This comparative view is instrumental in choosing the most suitable strategy aligned with one’s risk tolerance and financial objectives.

Decision Support

These charts serve as decision-making aids, empowering investors to make sound choices based on a comprehensive understanding of potential outcomes. By visually displaying the consequences of various decisions, individuals can make informed and calculated choices.

Educational Tool

Payoff graphs are an excellent educational resource for investors, traders, and students learning about financial markets. They provide a hands-on understanding of how different investment positions perform under various market conditions, fostering financial literacy and comprehension.

What Should One Be Careful of While Analysing Payoff Charts?

- Oversimplification: Payoff charts provide a simplified view of potential outcomes and may not capture all complexities or nuances of the market. They often assume static conditions, which might not reflect real-time market dynamics accurately.

- Ignoring External Factors: These charts may not account for external factors such as market news, geopolitical events, or sudden changes in economic conditions, which can significantly impact investment outcomes.

- Assuming Linear Relationships: Payoff charts typically assume linear relationships between variables like price and profit/loss. However, markets are rarely linear and can exhibit non-linear behaviours that payoff charts might not fully portray.

- Limited Time Perspective: They offer a snapshot view of potential outcomes at a specific point in time or price level, potentially overlooking the evolving nature of investments over extended periods.

- Risk of False Confidence: Relying solely on payoff charts without considering qualitative factors, fundamental analysis, or market sentiments can lead to overconfidence in a strategy that may not be robust in all market scenarios.

Option payoff charts in algorithmic trading, on platforms like uTrade Algos, serve as integral tools in quantitative analysis and algorithmic trading. Here one can access immediate, real-time insights into his strategy’s prospective earnings by instantly generating payoff curves for individual strategies or entire portfolios. This tool furnishes crucial information, empowering more informed decision-making processes.

Payoff charts offer traders a visual depiction of potential scenarios. Their role in guiding decision-making processes, risk assessment, and strategy formulation cannot be understated. In the dynamic landscape of options trading, understanding and leveraging these charts within quantitative and algorithmic models empower traders to navigate the market with greater confidence, accuracy, and success.

This said it’s essential to use payoff charts as part of a comprehensive analysis, considering them as tools that provide insights but not definitive predictions. Integrating them with broader market research and understanding their limitations can help investors make more informed decisions while minimising risks associated with oversimplified views of the market.

January 7, 2024

January 7, 2024