High-speed information flow. Decisions in the blink of an eye. A rush of adrenaline. In the good old days, the frenzy of a stock trading floor was pulsating, with hand signals moving millions of dollars and brokers shouting orders across each other. Today, trillions have replaced millions and are moved silently across accounts by computers in split seconds, the only noise being the soft hum of computer fans trying to cool the frenzy now locked inside their machines. All is calm outside. Welcome to the world of algorithmic trading, where men no longer solely lord the floors.

How Does Algorithmic Trading Work?

Trading can be impulsive, or it can be rule-based. Academia and your average Joe have cherished beliefs that stock market prices follow patterns or can be statistically predicted. But, of course, to counter them, there have always been those who believe that stock prices are random walks. So, the former has always tried hard to arrive at sets of rules by which a trader can predict prices. From drawing sophisticated charts to advanced statistical and mathematical models, all kinds of methods were invented to generate trading signals that would help a trader gain an edge over her rival. Moreover, having computers led to the belief that crunching large enough data sets would coax such patterns out. However, having patterns, charts, and signals was not good enough—there was the problem of good order execution. As was to be expected, trading humans were susceptible to emotion, looking over their shoulders, getting swayed by the crowd and prone to making mistakes. Hence, it was inevitable that the same computers used to crunch data and generate signals would take over the last-mile execution. Thus, algorithmic trading was born.

At its heart, the meaning of algo trading is not too complex to understand. An algorithm is just a set of rules. You program your computer and instruct it, ‘If this; do that’. Your computer is unlikely to reply, ‘My God, that’s crazy’, ‘This won’t work’, or ‘I punched the wrong key’ (for that, wait till computer programs become sentient with AI). So, the code will execute—and the only thing that would beat a program would be a faster, more optimised program on a faster machine. As was inevitable, this set off the colocation race where ever more powerful computers got placed at the heart of the exchanges to gain a nanosecond execution edge over a rival order for the best price.

So, to put across a formal definition of ‘what is algorithmic trading’, interchangeably referred to as algo trading or black-box trading, one could say that it uses computer programs to make trade decisions automatically at high speed in the financial market. It follows specific rules (called algorithms) using mathematical models and other market conditions, such as price, timing, and volume. After the investor sets the instructions, the trading software executes the orders in the market. Algorithmic trading is commonly employed by mutual funds, hedge funds, insurance companies, and banks, among others, to perform a substantial number of high-volume trades that would be impractical for humans to handle.

Algorithmic trading provides investors with the ability to conduct a greater number of trades within a limited time frame while minimising the impact of human emotions and trading mistakes.

Benefits of Algo Trading

Algo trading has multiple benefits, which has led to its wide adoption in the stock markets. Let us enumerate some of them below.

- It can quickly execute trades and high-volume orders.

- It has a high chance of execution at a predetermined price due to its swift speed.

- It helps to minimise human errors.

- Since orders are executed at high-speed significant price changes are avoided.

- It reduces transaction costs due to more efficient order fulfilment and higher exchange volumes.

- Investors can identify differently priced stocks in various markets, thus profiting from it.

How to Get Started with Algorithmic Trading?

Starting with algorithmic trading depends on your skill set and initiative as as a trader. At one extreme you would be a do-everything-myself trader who develops the logic to generate buy-sell signals, then codes a program based on it with proper testing, follows it up by backtesting signals on historical data, and finally, trades live by hooking to a stock exchange through licensed brokers. On the other end, you could be a let-professionals-do-it trader who puts money into a specialised algorithmic trading outfit that deploys enormous resources to do all this at a scale that an individual may not be able to match.

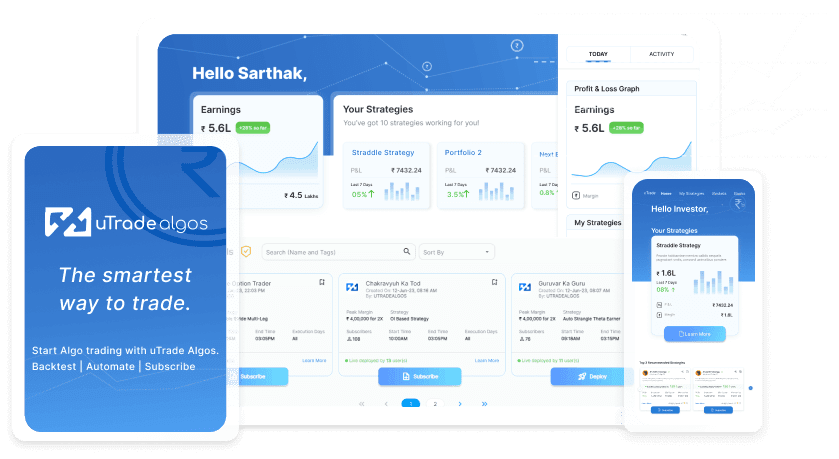

In between the two lie all the other possibilities that the market offers, which are now becoming the go-to solutions for retail traders. uTrade Algos offers a no-code platform that has all the tools traders need as they look to succeed in the markets. Apart from pre-made customisable strategy templates, it also has uTrade Originals, which are strategies made by experts, and deployable in just a single click.

Algo Trading Strategies

Investors use a variety of strategies for algorithmic trading, some of which are:

- Index Fund Rebalancing: Here, index funds adjust their portfolios to match the current market price of the underlying asset, providing opportunities for algo traders to profit from the expected trades and the difference of 20-80 basis points.

- Trend Following: This is the most popular algorithmic trading strategy among those who use moving averages, price movements, channel breakouts, and other indicators to create instructions for the algorithmic trading software.

- Arbitrage: Investors buy low-priced stocks from one market and simultaneously sell them in another where the stock price is high, thus making a profit from the price difference.

- Mathematical Model: Proven mathematical models are used to simultaneously trade on the same underlying asset’s stock and derivative, with algorithmic trading used to identify such assets and execute orders among various asset classes based on price fluctuations.

- Mean Reversion: This capitalises on the temporary highs and lows of an asset, aiming to buy/sell the asset automatically when it breaks in or out of the defined price range.

- Volume-Weighted Average Price: Investors aim to execute orders as close as possible to the volume-weighted average price, breaking up large order volumes into smaller chunks using algorithmic trading to achieve closing price goals.

- Time-Weighted Average Price: Similar to volume-weighted average price, this strategy also breaks up large order volumes into smaller chunks, but investors use divided time slots between the start and end time to execute the strategy.

Summing Up

Strict safeguarding of investor interest is paramount, above everything else, especially for small traders and investors who are perennially disadvantaged regarding knowledge and information. As a result, when it comes to algo trading, you need to remember that it is regulated heavily without bias and favour to create a level playing field for all traders. Hence, a new algorithmic trader would at least be at ease regarding systemic risks arising from the broader market when trading. The benefits of algorithmic trading, indeed, make it ideal for the newbie and the expert. Guess there is no looking back after this!

September 21, 2023

September 21, 2023