In recent years, India’s stock market has seen a remarkable surge, catapulting it to the status of the 4th largest in the world, leaving behind Hong Kong. This growth is not just a stroke of luck but a result of a confluence of several dynamic factors. The young Indian population, a burgeoning economy, increased retail participation in the stock market, and a boost in local manufacturing of global brands are key contributors to this phenomenon. Let’s delve deeper into these elements to understand the Indian market’s impressive ascent.

The Power of Youth

One of the most striking features of India’s growth story is its young population. With over 65% of its population under the age of 35, India boasts an energetic and vibrant workforce. This demographic dividend has translated into a significant increase in earnings and spending power. Young professionals are not only earning more but are also more financially literate and inclined towards investment. This shift in mindset is gradually transforming the landscape of Indian investments, with more young people participating in the stock market than ever before.

The Rising Economy

India’s economic growth has been noteworthy, especially in the post-COVID-19 era. The country has made significant strides in various sectors, including technology, pharmaceuticals, and manufacturing. This economic upturn has naturally fueled the growth of the stock market. Investors, both domestic and international, are showing increased confidence in India’s economic stability and growth potential, leading to higher investments in Indian stocks.

Retail Participation Since COVID-19

The pandemic brought about an unexpected twist in the tale of India’s stock market. While economies worldwide grappled with the pandemic’s impact, the Indian stock market witnessed a significant rise in retail participation. With more time at hand due to lockdowns and a plethora of online resources and platforms, individuals took a keen interest in stock market investments. This surge in retail investor participation provided a substantial boost to the market, adding depth and resilience.

Local Manufacturing of Global Brands

Another pivotal factor in the growth of India’s stock market is the increase in local manufacturing. With initiatives like ‘Make in India’, the country has seen a surge in the local production of goods, including those of global brands. This not only helped in reducing import bills but also attracted foreign investments. Companies setting up manufacturing units in India are often listed on the stock exchange, providing an added avenue for investors to participate in India’s growth story.

The China Spillover: India’s Manufacturing Edge

Amidst COVID-19, China’s inward turn, driven by geopolitical and pandemic-related factors, disrupted global manufacturing. This pivot opened doors for India, offering a strategic alternative for outsourced manufacturing. India’s response was swift and effective, rolling out policies to attract global manufacturers and investing in infrastructure improvements. This shift not only diversified India’s economy but also infused vigour into its stock market. The entry and expansion of foreign manufacturers in India have not only enhanced the country’s economic profile but also increased investor confidence. This phenomenon, a key driver in the growth of India’s stock market, underscores India’s rising stature in the global economic landscape.

Summing Up

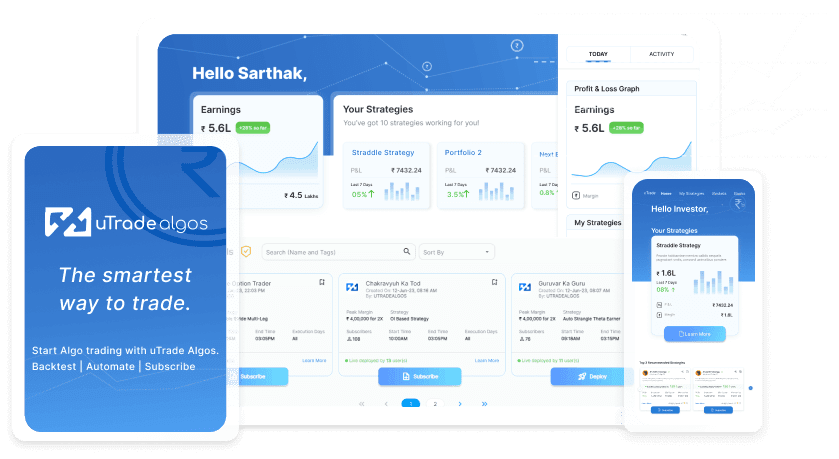

The ascent of the Indian stock market to its current position is a multifaceted story. As these trends continue, the market is expected to grow even further, offering a plethora of opportunities for investors. uTrade Algos aims to contribute to this growth by being at the intersection of cutting-edge technology and user-friendliness in algo trading.

January 23, 2024

January 23, 2024