The financial markets have always been dynamic, with traders constantly seeking methods to enhance their decision-making processes. One powerful strategy that has gained traction is the combination of chart patterns with algorithmic trading. This fusion leverages the historical significance of chart patterns for trading while harnessing the speed and precision of algorithms. In this blog, we'll explore the benefits of integrating chart patterns with algorithmic trading and how it can improve trading strategies.

Top 5 Common Mistakes to Avoid When Interpreting Payoff Charts

Amid the diverse strategies of options trading, payoff charts, on online algo trading platforms like uTrade Algos, stand as essential visual aids depicting potential profit or loss scenarios at different underlying asset prices upon options' expiration. These charts

The Top 7 Benefits of Using Payoff Charts in Algorithmic Trading

In the ever-evolving landscape of algorithmic trading, on platforms like uTrade Algos, where precision and swift decision-making are imperative, the integration of payoff charts has emerged as a pivotal tool for reshaping trading strategies. These graphical representations of potential profit or loss scenarios offer traders invaluable insights and advantages in navigating the complexities of financial markets. Here we find out the top seven benefits of utilising option payoff charts in algorithmic trading.

Crafting the perfect strategy in options trading requires a delicate balance between risk assessment, predictive analysis, and informed decision-making. Amidst the many tools available, option payoff charts stand out as indispensable instruments guiding traders through the complexities of quantitative analysis and algorithmic models, on various trading platforms like uTrade Algos. These charts serve as visual representations of potential profit or loss scenarios at various price levels of the underlying asset, offering traders a clearer perspective on the risk and reward dynamics associated with their positions. Let us understand more.

The Importance of Real-Time Data in Algo Trading Software

In today’s dynamic markets, be it algo trading in India or otherwise, access to precise market data stands as a fundamental requirement for traders. It serves as the bedrock for making well-informed decisions regarding the purchase or sale of stocks, currencies, and futures. Being aware of market trends and developments holds paramount importance, enabling traders to identify profitable opportunities while effectively managing risks.

The Impact of Technology on Algorithmic Trading in India

The landscape of financial markets in India has been significantly transformed by the integration of advanced technologies into trading practices. One of the most prominent and impactful advancements is the rise of algorithmic trading. This blog aims to explore the profound influence of technology on the algorithmic trading platform in the Indian financial markets, highlighting its evolution, benefits, challenges, and prospects.

The Impact of Artificial Intelligence on Algorithmic Trading

The fusion of Artificial Intelligence (AI) with algorithmic trading has redefined the landscape of financial markets. AI-driven strategies and technologies have revolutionised how trading decisions are made, enhancing precision, speed, and efficiency.

How Do Calls and Puts Work: A Comprehensive Guide

The domain of trading calls and puts allows investors to adopt diverse strategies to capitalise on market movements. This comprehensive guide aims to delve deeper into the concepts of calls and puts, exploring their intricacies, types, strategies, pros and cons, and their integration with algorithmic trading. Read on to learn more.

7 Essential Tools Every Algorithmic Trader Needs in Their Arsenal

Algorithmic trading, a sophisticated method of executing trades based on pre-defined algorithms, demands a comprehensive set of tools for success. This article explores essential tools crucial for algorithmic traders to navigate financial markets effectively. Moreover, it delves into the characteristics of an algo trader, potential pitfalls to avoid, and the future landscape of algorithmic trading.

7 Essential Steps to Develop a Profitable Algorithmic Trading Strategy

Algorithmic trading strategies have revolutionised the financial markets, offering traders automated solutions for executing trades based on predefined rules. Crafting a profitable algorithmic trading program involves a systematic approach and careful consideration of various elements. This comprehensive guide outlines seven crucial steps to assist traders in developing a robust and profitable algorithmic trading strategy.

Claim your 7-day free trial!

- 2 Backtests per Day

- Access to uTrade Originals

- Create Upto 5 Algos

Frequently Asked Questions

Expand All

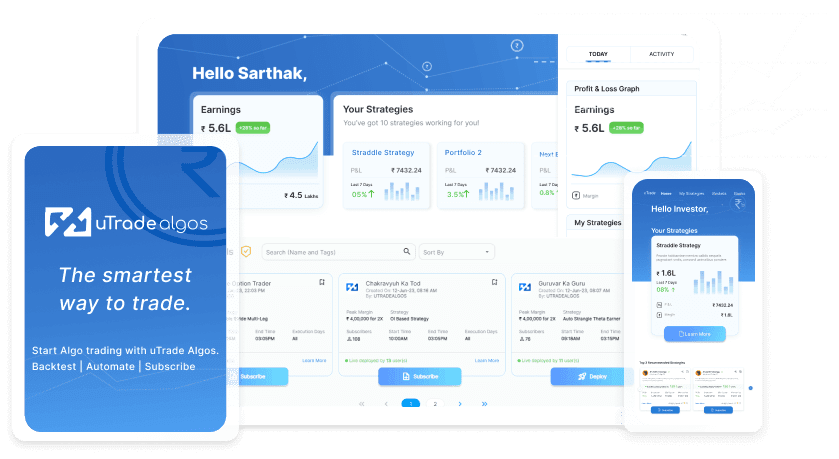

uTrade Algo’s proprietary features—advanced strategy form, one of the fastest algorithmic trading backtesting engines, and pre-made strategies—help you level up your derivatives trading experience

The dashboard is a summarised view of how well your portfolios are doing, with fields such as Total P&L, Margin Available, Actively Traded Underlyings, Portfolio Name, and Respective Underlyings, etc. Use it to quickly gauge your algo trading strategy performance.

You can sign up with uTrade Algos and start using our algo trading software instantly. Please make sure to connect your Share India trading account with us as it’s essential for you to be able to trade in the live markets. Watch our explainer series to get started with your account.

While algo trading has been in use for decades now for a variety of purposes, its presence has been mainly limited to big institutions. With uTrade Algos you get institutional grade features at a marginal cost so that everyone can experience the power of algos and trade like a pro.

On uTrade Algos, beginners can start by subscribing to pre-built algos by industry experts, called uTrade Originals. The more advanced traders can create their own algo-enabled portfolios, with our no-code and easy-to-use order form, equipped with tons of features such as robust risk management, pre-made algorithmic trading strategy templates, payoff graphs, options chain, and a lot more.

From single-leg strategies to complex portfolios, with upto five strategies, each strategy having up to six legs, uTrade Algos gives one enough freedom to create almost any auto trading strategy one likes. What’s more, is that there are pre-built algos by industry experts for complete beginners and pre-made strategy templates for those who want to try their hand at strategy creation.

An interesting feature that uTrade Algos is bringing to the table is a set of pre-built algorithms curated by top-ranking industry experts who have seen the financial markets inside out. These algorithms, called uTrade Originals, will be available for subscribers on the platform.

Algos have the capability to fire orders to the exchange in milliseconds, a speed which is impossible in manual trading. That is why traders leverage the power of algo trading to make their efforts more streamlined and efficient. You can try uTrade Algos for free for 7 days!