Don’t wish to risk real capital while learning? Don’t have a Demat account? Want to test your strategies in a simulated market before deploying them in the live markets?

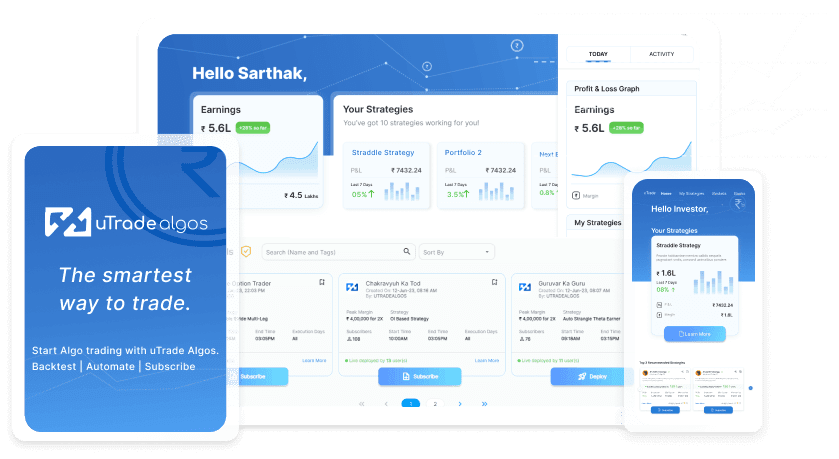

uTrade Algos automates the entire process using a proprietary, modern paper trading simulator which closely resembles real world stock trading.

Are you too scared of words like investing, stocks, market etc? Is that what is holding you back from investing in stocks? Are you too afraid of ‘getting it wrong’ and losing your hard-earned money?

If your answer to any of the questions above is yes. Don’t worry, we got you.

Stock investing can be a little nerve-wracking, at first, but you can always start with paper trading, or as it is sometimes known, virtual trading. Now, what is this paper or virtual trading?

Understanding Paper Trading

Paper trading, also called forward performance testing or forward testing, is the practice of trading either digitally or manually, without the involvement of real money. It involves practising placing buy and sell trades without the risk of losing a single rupee. This means you can’t make real profits, but it also means you can’t lose real money.

Traditionally paper trading was done by simply writing trades down or entering them in a spreadsheet and then manually comparing it with the price movements of stocks on every session.

uTrade PRO, one of the best paper trading platforms, we automate the entire process using a proprietary, modern paper trading simulator or a demo account, which closely resembles real world stock trading platforms. For our existing customers, uTrade PRO offers sophisticated paper trading abilities through demo accounts (or as a feature). Moreover, we help you set up a Day Trading Account or a uTrade PRO basic account to allow you to practise paper trade for free.

In short,

Paper Trading = Live Trading – Risk

Let’s understand it with an example. Let’s say you’ve been reading books, blogs, articles and watching videos about how to start trading, or you are an experienced trader who wants to try something new. In both cases, you may want to start testing your trading strategy. Now your first task would be to zero-in on what shares to try on. Let’s assume you believe that SBI shares are going to breakout at ₹500. Your strategy is to record the entry when the stock hits that point and record the exit whenever the time is right.

If you do this for all your trades then, as you go through them at the end of the day, you will be able to see what you did right or wrong, and most importantly, you would be doing so without actually putting your money at risk. This is known as paper trading or forward testing.

To summarise:

- Paper trading or forward testing is trading without the actual use of real money.

- Initially, it was done manually.

- Nowadays, paper trading happens digitally.

- uTrade PRO, the best paper trading app, allows automation of the process.

Benefits of Paper Trading

1. Learning to Trade

Let’s face it – whenever we start something new, we arel nervous and unsure of ourselves. Paper trading gives you the ability to try without that fear holding you back. It allows you to experiment without worrying about losing money. You can explore different avenues of investing and see which fits you the best.

2. Stress Free Trading

Paper trading removes two of the biggest emotions that can cloud your decisions while investing, mainly, fear and greed.

Fear of not making money when you have the chance or the fear of missing out on that one big trade that could make you wealthy can be a powerful emotion. Greed can be the next biggest emotion we deal with while investing. Paper trading helps eliminate both of these emotions from your trading since you have no fear or greed involved. It allows you to focus on your strategy

and not on the money involved. With these learnings and discipline, you are likely to trade better in the live markets.

3. Helps to Make a Confident Trader

The confidence you gain from utilising forward testing accounts is invaluable. Nothing builds your confidence in your investing ability like executing trades and seeing the potential monetary gains.

To summarise:

- Forward testing allows beginners to learn how to trade

- Fear and greed take a backseat in paper tradingPaper trading builds confidence

Limitations of Paper Trading

As they say, there are two sides to a coin. We, at uTrade PRO, believe that despite all its advantages, forward testing does have some limitations. Even though those limitations can be curbed if you are careful, still, for traders who are planning to test their strategies via this method, it is best to know what these cons are:

- Inability to Completely Predict Market Fluctuations

A market’s impact on the various strategies is not addressed in paper trading. This is because at times of high correlation, which is generally when the Market Volatility Index (VIX) rises, the equities usually move in lockstep with major indices. Hence, even if a result looks very good or very bad on paper, there is the chance that other conditions will lead to a different result of the strategy in real life.

- Hidden Costs

When trading with real money comes into play, there are many hidden costs in the form of slippage and commissions. This is usually poorly captured by forward testing methods.

- Human Emotions

In the real world, due to lack of market discipline, often traders cut profits short and let losses run. These are self destructive and not taken into account when dealing with virtual strategies via a paper trading simulator.

- Ideal Conditions

Working with algorithms allows traders to pick ideal entries and exits. While doing so, they miss out on how it actually works in the real world where timing may not always be perfect. The real world obstacles are often negated in a computer-driven environment. Hence, when the same strategy is implemented in the real market, it doesn’t give the same results as it did when a paper trading simulator was used.

Best Practices of Paper Trading

It is of no doubt that Paper trading is a great resource available not only for beginners but also for experienced traders. Beginners are able to learn the basics of trading in a risk-free environment, get used to their trading platforms, and learn how to get rid of emotions in trading. Experienced traders can take advantage of demo accounts by front-testing some new trading strategies before applying them on live markets. Whether you are a beginner or an experienced trader:

- Regularly practise and maintain records to maximise your insight about your strategies. Experiment with your strategies in both bull and bear markets in order to experience every movement.

- Always adjust returns from forward testing with operational costs like broker commissions, government taxes etc., otherwise your results might mislead you.

To summarise:

- Paper trading is beneficial for beginners and experienced traders

- Regular practise enhances learning

- Experiment in both bull and bear markets

- Returns should always be adjusted to get more accurate pictures

Backtesting Vs Paper Trading

Backtesting and forward testing exist for the same purpose – to help you experiment and predict the outcome of your trading strategies better. However, they are not identical.

As you know by now, paper trading happens on live market data and helps you build an outlook on the current and upcoming market environment.

However, when a strategy is backtested, historical market data is used to get an indication of how well the strategy would have done in the past over a period of X days/months/years. Each trade included in backtest results is a simulated trade based on historical data.

To conclude, it can be said that no one competes in the Olympics without practising their game in a local stadium.

To summarise:

- Both paper trading and backtesting help to experiment and predict outcomes

- Paper trading is practised in live markets

- Backtesting uses historical data to predict how well a strategy would have done in the past

In conclusion:

- Both beginners and experienced traders will benefit from paper trading

- Paper trading allows one to test strategies without the fear of losing money

- Nowadays forward testing/paper trading happens digitally rather than manually

- uTrade PRO is one of the best paper trading platforms to conduct forward testing digitally

uTrade PRO provides you with the practising stadium of trading, where you can paper trade any stock in real-time, with the help of virtual money via mobile or web bot anytime, anywhere.

Use uTrade PRO, the best paper trading app, for live trading news and analytics and take lessons from building thousands of trading strategies, before risking your real money. Try for yourself – signup at uTrade PRO.

Forward testing is a risk-free way to practice trading strategies.

uTrade Algos offers a modern forward testing simulator to automate the process, closely resembling real-world trading platforms.

Forward Testing is a stress-free way to learn and experiment with trading without worrying about losing money or getting overwhelmed by emotions like fear and greed.

Forward Testing helps build confidence and discipline in trading.

Limitations include the inability to predict market fluctuations, hidden costs, and the lack of accounting for human emotions and real-world obstacles.Despite its limitations, Forward Testing is a useful tool for traders, especially for beginners.

Explore uTrade Algos‘ modern algo forward trading simulator to practice trading strategies with zero risks and build confidence and discipline in trading. Sign up for a demo account today!

April 3, 2023

April 3, 2023